IR Information

Research and Development / Intellectual Property Cross-Functional Strategy Supporting Business Growth Fuji Electric Report 2025

We will challenge ourselves to create new products and acquire new technologies that will drive Fuji Electric’s growth strategies.

Executive Officer

Corporate General Manager, Corporate R&D Headquarters

Kazuya Nakayama

Even as the business environment becomes more uncertain, we believe that trends such as the transition to a decarbonized society, the shift to a circular economy, and expanded investment in digitalization will continue. To solve the new challenges our customers face as a result of these trends, we are refining our core technologies and strengthening development of global products, and new products that contribute to green transformation (GX) and digital transformation (DX). Furthermore, we are challenging ourselves to acquire innovative new technologies through collaboration and co-creation with partner companies and academia, aiming to create new products that meet new needs by anticipating how social issues will change.

We are also working to build an intellectual property portfolio to ensure competitive advantages for our new products and technologies, and we are engaged in international standardization activities, which are essential to expanding our business globally.

Progress of Medium- to Long-Term R&D

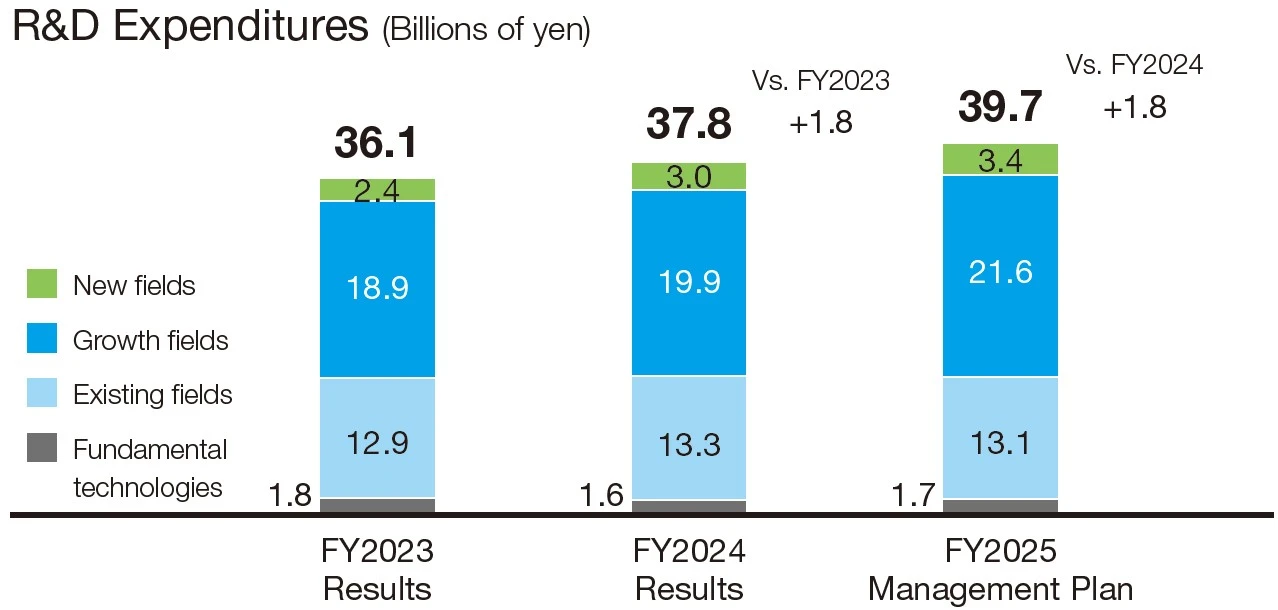

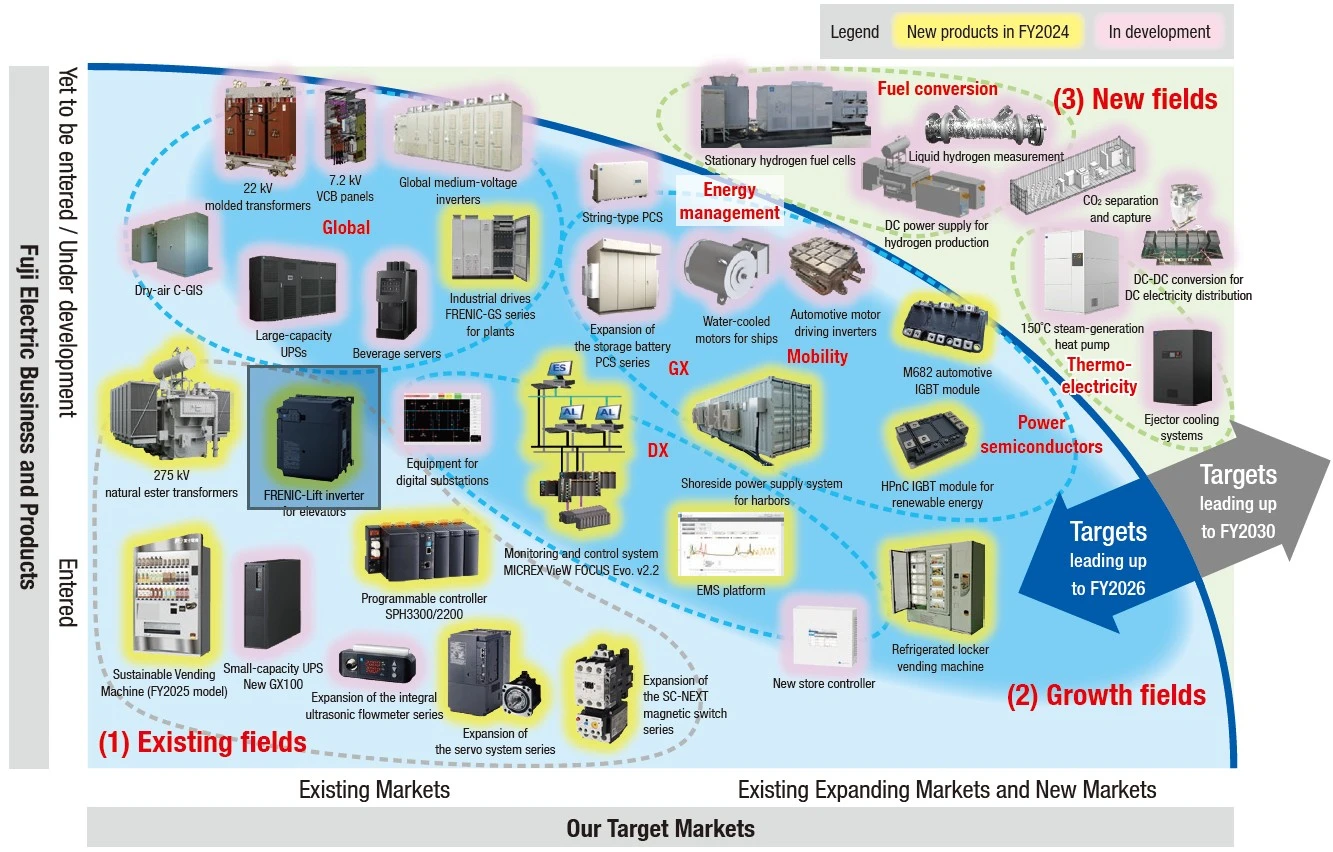

As our R&D strategy in the FY2026 Medium-Term Management Plan, which began in fiscal 2024, we are promoting the development of new products in our existing fields (1) and growth fields (2), as shown in the R&D portfolio (on the next page), while engaging in R&D in new fields (3) that will contribute to growth from 2030 onward.

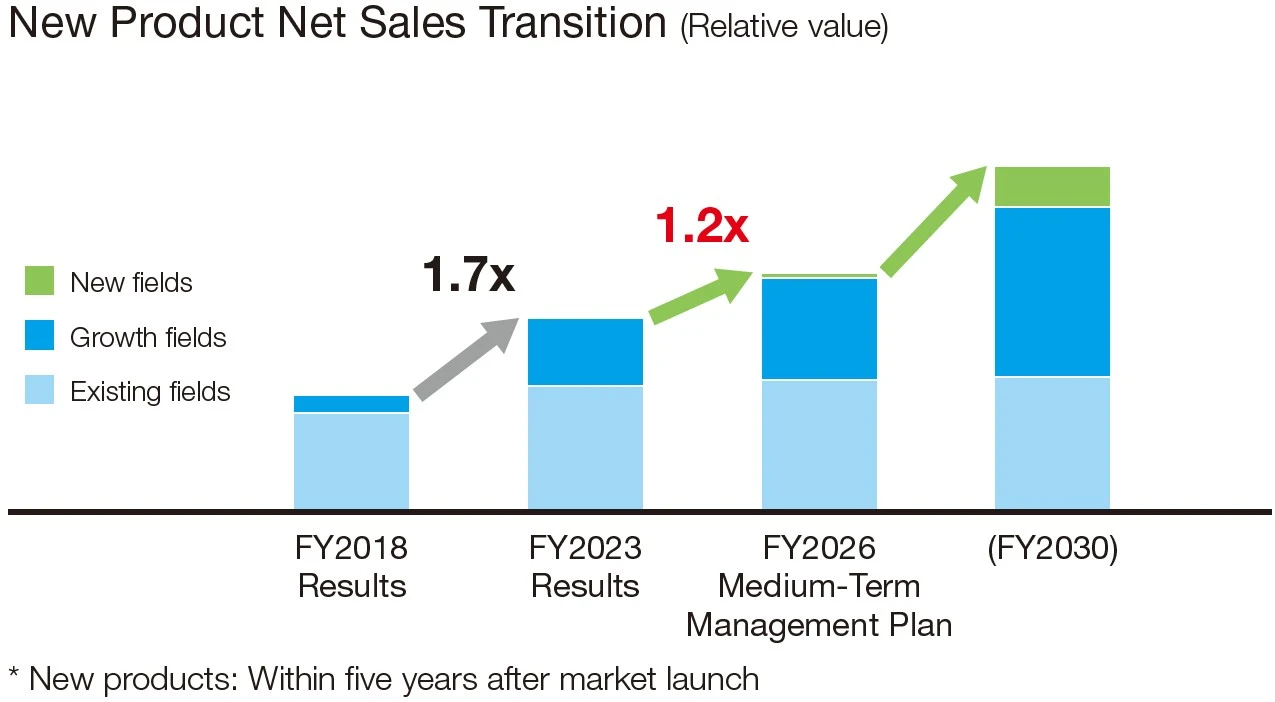

To realize this R&D strategy, we have set our R&D expenditures for fiscal 2025 to ¥39.7 billion, an increase of ¥1.8 billion year on year. Building on our efforts in fiscal 2024, we will expand investment in R&D in growth and new fields that support our growth strategies. Furthermore, for new product net sales (within five years of launch), which we position as our most important R&D KPI, we have set a target for fiscal 2026 of at least 1.2 times the level of fiscal 2023.

Main Development Progress in FY2024

In our existing fields of business (1), we have launched the next-generation model of programmable controllers and inverters for elevators, expanded our series of servo systems and natural ester transformers, and are developing products such as small-capacity UPSs and ultrasonic flowmeters.

In the GX-related growth fields (2), we completed the development of new power semiconductor modules for electrified vehicles and renewable energy. In the mobility field, we launched a shoreside power supply system for harbors, and in the energy management field, we advanced the development of products such as string-type PCS for solar power. In DX-related areas, we completed the enhancement of engineering functions for plant monitoring and control systems and the development of an EMS platform, and we are developing equipment for digital substations. Furthermore, as global products, we have launched drive systems for plants in industries such as steel and cement, and are advancing the development of dry-air C-GIS, VCB panels, and beverage servers.

In the new fields (3), we have worked to create new products that will contribute to growth from fiscal 2030 onward and to acquire the new technologies necessary to do so.

R&D Portfolio and Main Progress Items

-

1) Existing fields “Develop next-generation models, strengthen competitiveness, and expand platform development” to maintain and expand our existing businesses

-

(2) Growth fields “Launch GX, DX, and global new products by fiscal 2026” to drive our growth strategies

-

(3) New fields “Challenge ourselves to acquire new GX technologies and create new products” in anticipation of market expansion from fiscal 2030 onward

Strengthening New Product Creation and New Technology Acquisition

As we proceed with creating new products and acquiring new technologies in fields that are new to our company and that are expected to see market expansion from fiscal 2030 onward—such as “fuel conversion,” “thermoelectric systems” (see Industry, P32), and “CO2 separation and capture”—we are expanding our co-creation with partner companies.

Aiming to realize fuel conversion from fossil fuels to ammonia, we and ITOCHU Corporation are participating in the “Development of Peripheral Equipment in the Construction of a Supply Chain for Ammonia-Fueled Ships,” one of the Green Innovation Fund projects of the New Energy and Industrial Technology Development Organization (NEDO). By combining the measurement technologies we have cultivated to date with new high-sensitivity technologies, we are working to develop leakage sensors for safely handling hazardous ammonia and equipment for recovering residual ammonia.

In addition, in fiscal 2024, we invested in the following two startups and began collaborating with them. Going forward, we will continue to actively promote acquisition of new technologies by investing in promising partner companies.

— On-Site-Oriented AI Services for the Manufacturing Industry —

Hutzper Inc.

Hutzper’s strength lies in its ability to provide its proprietary AI technology, which realizes visual inspections through image analysis and optimal personnel allocation on production lines, in a high-quality package. By creating solutions that generate synergies when combined with our products, we aim to strengthen our smart factory business.

— Proprietary Solid-Solution Alloy Nanoparticle Manufacturing Technology —

Illuminus Inc.

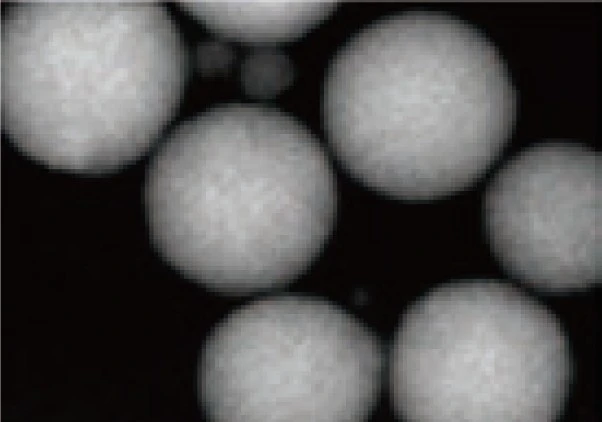

Illuminus possesses technology for stably producing solidsolution alloy particles with a diameter of 10 nm or less, that are composed of multiple elements. By utilizing this technology to develop high-performance new materials such as catalysts applicable to the power semiconductor and clean energy fields, we aim to create competitive new products that contribute to realizing a decarbonized society.

Intellectual Property Initiatives

We position intellectual property as a key management resource and, under our intellectual property policy, we secure competitive advantages for our products by strategically acquiring and utilizing intellectual property rights, while promoting compliance with the international standards required in the global market.

Over the medium to long term, in addition to strengthening our intellectual property and international standardization activities for businesses and products in growth fields, we are utilizing intellectual property analysis to improve our market analysis capabilities in order to create new products.

Intellectual Property Policy

-

Develop and implement intellectual property strategies by analyzing intellectual property.

-

Strengthen each business’s intellectual property portfolio and reduce risks.

-

Strengthen strategic international standardization activities.

Strengthening Our Intellectual Property Portfolio

The intellectual property rights we hold are managed as per-business intellectual property portfolios (our intellectual property is categorized by major technology), and we continuously perform maintenance, such as deciding whether to keep or abandon rights, by taking into account changes in the business situation.

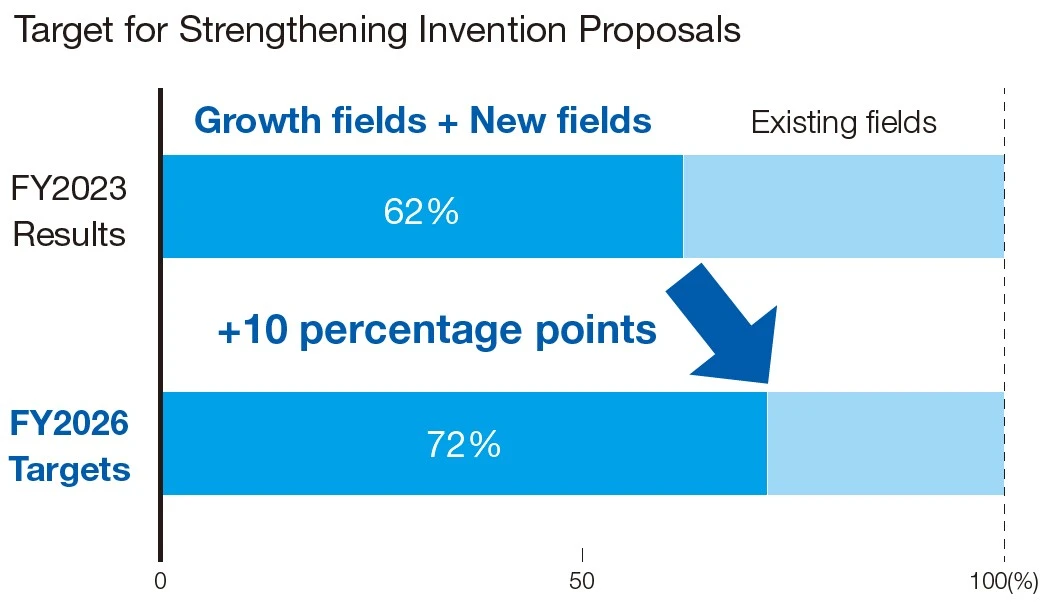

In fiscal 2024, we also began activities to support the growth strategies for each field set forth in the Medium- Term Management Plan. Specifically, we have set a goal of increasing the total number of invention proposals in growth fields (e.g., GX and DX) and new fields (e.g., fuel conversion and thermoelectricity) defined in the plan by 10 percentage points by fiscal 2026. To do so, we are working closely with the R&D division and jointly proceeding with activities to extract invention proposals.

We will continue these initiatives and support our growth strategies from an intellectual property perspective.

Utilizing Intellectual Property Analysis (IP Landscapes) for New Product Creation

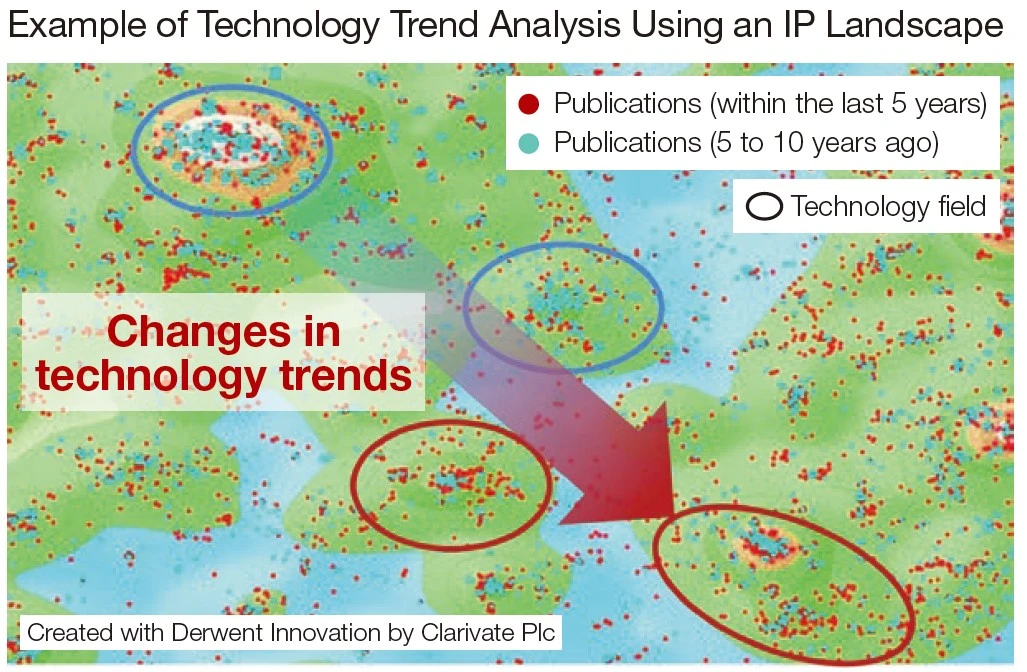

To create highly competitive new products, we actively utilize IP landscapes from the initial stages of product development. IP landscaping is a method that supports strategic decisionmaking by analyzing technology trends and key industry players based on published patents and academic papers.

In fiscal 2024, we applied the IP landscaping process to over 30 projects. For example, in business fields that we have yet to enter, we are promoting initiatives for strategic new product creation, such as formulating new development themes based on technology trend analysis (see the figure on the right).

Strengthening International Standardization and Rulemaking Activities

We systematically promote compliance with international standards and the acquisition of certifications necessary for overseas business expansion. Policies and strategies are decided by the International Standardization Committee, on which the Corporate General Managers of each Business Group serve as members, and based on these policies and strategies, working groups formed for each business field carry out international standardization activities.

Furthermore, in new fields such as GX, we are developing “rulemaking activities” in which we proactively participate in standardization activities in Japan and overseas from the formulation stage based on market trends, aiming to contribute to our business. As part of this, in fiscal 2024 we participated in a demonstration experiment in collaboration with an industry association (see TOPICS on the next page).

R&D TOPICS

Establishment of the “Fuji Electric × Tohoku University Advanced Technology Co-creation

Research Center” to Strengthen Basic Research in Power Electronics and Power Semiconductors

Research Center” to Strengthen Basic Research in Power Electronics and Power Semiconductors

Tohoku University and Fuji Electric established the “Fuji Electric × Tohoku University Advanced Technology Co-creation Research Center” in November 2024 to promote research activities in the fields of power electronics and power semiconductors with the aim of realizing a decarbonized society.

At this co-creation research center, we will fuse our technologies in the power electronics and power semiconductor fields with Tohoku University’s advanced research capabilities across a wide range of areas, including materials, processes, devices, circuits, equipment, and systems. By doing so, we will accelerate research into high-efficiency, compact power modules and power supply and drive systems, while working to explore joint research themes for creating new value to contribute to the realization of a decarbonized society.

Tohoku University’s “Co-creation Research Center” system promotes a variety of activities, including planning and promotion of joint research, human resource cultivation, and collaboration with university-launched ventures. It does so by establishing bases for collaboration with companies within the university, enabling cross-departmental access to the university’s faculty, knowledge, and facilities.

Intellectual Property TOPICS

Strategic Rulemaking Activities in the GX Field

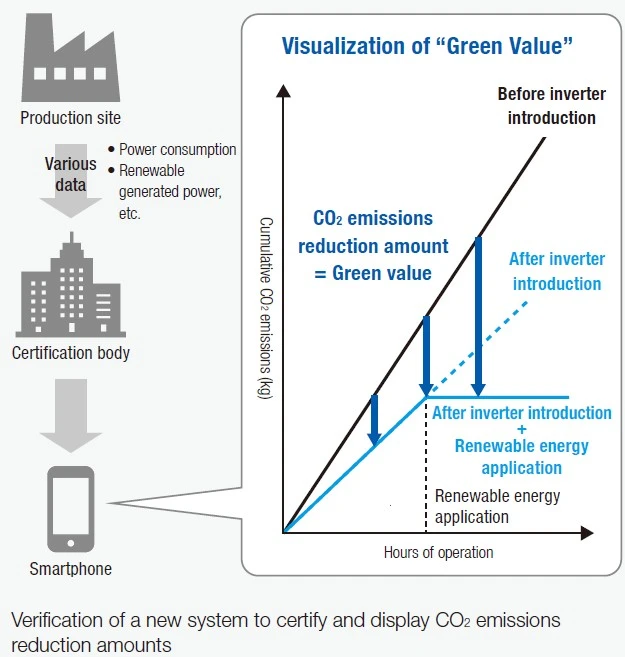

In fiscal 2024, in collaboration with the Japan Electrical Manufacturers’ Association (JEMA) and three JEMA member companies, we constructed and verified a new system to certify and display CO2 emissions reduction amounts at production sites. Specifically, we built and verified a system that sends various data to a certification body when introducing inverters for motor drives and when applying renewable energy (solar power), and then visualizes the third-party-certified CO2 emissions reduction amounts on devices such as smartphones. By presenting the amount of CO2 emissions reduction as the “green value” of a product in this way, we can enhance the added value of energy-saving products and make an appeal to environmentally conscious customers.

We are participating in rulemaking activities, including the development of guidelines, with the aim of promoting the adoption of this new system. Through these initiatives, we will advance our business strategically, capture new GX demand, and contribute to the medium- to long-term expansion of our business and profits.