IR Information

Interview with the President and COO Fuji Electric Report 2025

Enhancing profitability and driving

our growth strategy,

we will challenge ourselves to create new products and new businesses

for the sustainable improvement of corporate value

President and COO

Shiro Kondo

Q: What is your assessment of earnings in fiscal 2024?

The environment surrounding the Company presents growth opportunities, such as increased capital investment driven by decarbonization and the proliferation of generative AI. However, future uncertainties remain due to heightened geopolitical risks and the emergence of protectionism.

In all of this, we have united as a team to implement the basic policy of the FY2026 Medium-Term Management Plan to enhance corporate value through management emphasizing profit. We have achieved record-high net sales, operating profit, ordinary profit, and profit attributable to owners of parent, and we have also realized our target of an operating profit ratio exceeding 10%. In the components business, which has hitherto driven net sales and profits, the FA applications and the ED&C components business bore the brunt of market influences, however earnings rose sharply for plant systems in the Energy and Industry segments, as well as in the Food and Beverage Distribution segment. Achieving these results, despite the challenging environment, owes to the dedicated efforts of all employees.

Plant systems in the Energy and Industry segments are driving growth

In the Energy segment, demand for power generation equipment, substation equipment, and power supply equipment expanded due to increased electricity demand. In the energy management business, demand for equipment replacement in industrial and power infrastructure remained brisk, resulting in a 31% year-on- year increase in orders and a 5% increase in net sales. In the power supply and facility systems business, the bundled delivery of uninterruptible power systems (UPS) and substation equipment for data centers (IDCs) in Japan and overseas, along with comprehensive electrical equipment systems including after-sales services, performed well. This led to a 24% year-on-year increase in orders and a 4% increase in net sales. In response to customer inquiries, we are also strengthening our production systems by introducing large-capacity short-circuit testing equipment at our Chiba Factory, which will help shorten development times.

In the Industry segment, we have tapped into the decarbonization needs of the materials industries, such as steel and chemicals, thereby boosting growth in plant systems centered on drive control systems in Japan and Asia. On the other hand, in the components business, customer inventory adjustments for low-voltage inverters continued, and demand from machine manufacturers in the ED&C components business was sluggish.

In the Semiconductors segment, weak demand for xEVs and FA applications, but investments in future growth continue

In the Semiconductors segment, demand for xEVs, which had been growing, weakened from US and European customers, and the recovery in factory automation products, such as inverters and servo systems, was slow. That said, demand from xEV makers in Japan and renewable energy projects overseas remained strong. With a view to future growth, we are augmenting production capacity for 8-inch silicon devices (front-end processes) at Fuji Electric (Malaysia) Sdn. Bhd., while silicon carbide production at Fuji Electric Tsugaru Semiconductor Co., Ltd. has been pushed back from initially planned June 2024 to December 2024 to meet customer demand. We have commenced volume production of 6-inch (front-end) devices.

In the Food and Beverage Distribution, we boosted profitability by capitalizing on demand related to Japan’s redesigned banknotes and by stepping up the launch of high-value-added products

In the Food and Beverage Distribution segment, due to redesigning banknotes in Japan, the store distribution business established technology to identify holograms and other features incorporated into the new banknotes, which have been redesigned, for anti-counterfeiting purposes. Also, to respond to short-term special demand for hardware replacements and software updates for automatic change dispensers, we flexibly built out a production and service framework by appropriately allocating parts procurement and production/service personnel. These efforts led to greater-than-expected sales. In the vending machines business, we stepped up the rollout of high-value-added products, including sustainable vending machines capable of achieving energy savings of up to approximately 20% compared to conventional machines. This has meant our share of the vending machines market in Japan has increased from around 70% to above 70%.

Net sales down overall in overseas operations, but up in India

Although overseas net sales overall decreased year on year primarily due to the dropout of year-earlier large-scale projects for semiconductor factories in the power supply and facility systems business in Asia, sales of inverters for elevators and air conditioning equipment, as well as power supply equipment for IDCs, expanded in India, where economic growth continues in the Industry segment.

Q: How do you view the business environment surrounding the Company?

In fiscal 2025, we expect to see growth in energy demand driven by increased capacity at AI data centers and semiconductor factories, as well as the ongoing need for green transformation (GX), the replacement of aging equipment, equipment maintenance, stable energy supply, energy savings, and electrification. On the other hand, xEV demand is showing signs of variation across different regions. Moreover, there is a growing number of case examples of how generative AI and digital technology are being used to combat labor shortages. Business opportunities are expanding in areas such as deterioration diagnosis and remote operation of substations, advanced monitoring and control that consolidates factory and plant on-site operations, efficiency improvements in vending machine operations, and store energy management.

As to the impact of US trade policies, our sales weighting to the Americas is low at 3% to 4% of total sales, and at this juncture, the direct impacts are limited. While the situation remains difficult to predict, we will continue to carefully listen to customer feedback, accurately assess market trends, and generate business opportunities by creating new customer value.

Q: Can you tell us about the basic policy and management targets for fiscal 2025?

In fiscal 2025, we will continue to target sales and profit growth in line with the basic policy of the medium-term management plan to enhance corporate value through management emphasizing profit. In particular, with the semiconductor industry entering a challenging phase, we will carefully assess the timing for executing our investment plans aimed at further growth in the future. We will work on strengthening our profitability through productivity improvements utilizing digital technology, while also advancing growth strategies by, for example, expanding business operations through new product launches, growing our overseas operations, and creating new businesses that will contribute to net sales growth from fiscal 2027 onward.

Our management targets are net sales of ¥1.14 trillion, operating profit of ¥118 billion, an operating profit ratio of above 10.4%, profit of ¥81 billion, and ratio of profit attributable to owners of parent to net sales of at least 7.1%. While we anticipate lower sales and profits in the Semiconductors and Food and Beverage Distribution segments due to weaker demand from xEVs, the winding down of special demand in the store distribution business stemming from the redesigned banknotes, and curtailed investments from vending machine customers in Japan, our

sights are still set on posting year-on-year sales and profit growth, driven by the Energy and Industry segments. We plan to enhance our profitability across all businesses and achieve the medium- term management plan’s target of at least 7% for ratio of profit attributable to owners of parent to net sales one year ahead of schedule, independent of temporary factors such as gains on the sale of cross-shareholdings in the previous fiscal year.

Energy and Industry segments the drivers

In the Energy segment, we will harness synergies with Fuji Electric Engineering & Construction Co. Ltd., which handles equipment construction, to bolster our one-stop solutions that help shorten project lead times for customers and contribute to decarbonization. We will continue to focus on potential growth fields, including comprehensive electrical equipment for IDCs and semiconductor factories, as well as expand orders for renewable energy and storage battery systems, where new growth is expected. In response to robust demand, we will construct a new production facilities at our Kobe Factory to increase the production capacity of switchgear and controlgear and power supply boards, as well as to make preparations for production equipment for skid systems. Plus, we will work on transferring and optimizing the models produced at the Chiba Factory and the Kawasaki Factory to boost the production capacity of transformers and switchgear. In the power generation business, we will continue to work on improving profitability by expanding the business with stronger proposals for maintenance and service-related products, as well as by conducting more rigorous risk assessments during the order phase for overseas projects and enhancing project management oversight functions.

In the Industry segment, even though we look for a gradual recovery in demand for components, such as low-voltage inverters and ED&C components, from the latter half of fiscal 2025, the global supply chain has been disrupted since the outbreak of the COVID-19 pandemic. In particular, the FA components business has succumbed to an imbalance in supply and demand, making usual demand forecasting and production planning based on empirical evidence increasingly ineffective.

To resolve this issue, we will implement organizational changes (integrated production and sales) that integrate the functions of sales, development, manufacturing, and business divisions to centralize decision-making within the business divisions. We will work on strengthening our product planning capabilities centered on customer value creation, improving forecasting accuracy, and enhancing global procurement and production management, thereby aiming to achieve stronger profitability and medium- to long-term growth. In the automation systems business, we will strengthen our proposals for solutions that combine automation with energy savings in electrical and thermal energy, electrification, and other forms of added value in an effort to address the energy challenges of our customers and expand our business. In the burgeoning Indian market, we will enter the smart meter business, which is being promoted as part of the country’s national policy. We will establish production lines in the country, promote the localization of materials procurement while ensuring the Bureau

of Indian Standards (BIS) certification and high quality, and aim to further expand our business.

In Semiconductors, we will ramp up new product development, secure new design wins, and develop new customers

We will invest in production capacity upgrades in response to changes in the demand environment

We will invest in production capacity upgrades in response to changes in the demand environment

In the Semiconductors segment, while demand from xEVs is currently in decline due to model changes among customers in the United States and Europe, demand for renewable energy applications remains strong. Both applications are expected to expand in the medium-to-long term. On the other hand, responding to the price offensives of local semiconductor makers in China is something we need to address. We will strengthen our efforts to accelerate the development of competitive new products, secure new design wins, and develop new customers to further drive business growth.

In addition, we will steadily make investments to augment production capacity in preparation for future demand growth, while controlling how fast we respond to changes in the demand environment.

In Food and Beverage Distribution, we will expand sales of high-value-added products and new products, and also strengthen profitability

The Food and Beverage Distribution segment will be impacted by curtailed investments by beverage manufacturers in Japan and the winding down of demand related to Japan’s redesigned banknotes, but the need for automation, labor savings, and environmental measures will persist, so we expect to see growth in demand in new areas for the Company. In light of these factors, we will strive to improve energy-saving performance, improve the efficiency of vending machine operations with the use of digital technology, and develop machines that are compatible with dynamic pricing mechanisms that adjust product prices based on supply and demand conditions, thereby increasing the added value of products. In the store distribution business, we will expand our business fields beyond convenience stores and supermarkets and aim to strengthen our business foundation with a view to further sales growth. We will identify the right time to introduce various new products to customers in such new fields as the restaurant, food products, and distribution industries. Also, in our overseas operations, we will aim to enter the Indian market to complement our presence in China and Southeast Asia, and we will leverage collaborations with partner companies to expand our business.

Q: Can you elaborate on how you will utilize digital technology to improve productivity?

For the Company to achieve sustained growth, it is imperative that we accurately understand the diverse needs of our customers and society, and to engage in problem-solving and the creation of new value. To cope with increased sales volume and administrative work as a result of further business growth, we will look to improve labor productivity and equipment productivity and drive up both sales and profits. To achieve this, we will promote data-driven management that does not rely solely on past experiences. As part of this initiative, we will invest in information systems related to our business activities to streamline and optimize business processes. We will also aim to accelerate management decision-making and undertake an upgrade of our core systems based on global business data integration and real-time visualization and analysis.

In fiscal 2024, we made progress on the utilization of digital technology guided by our factory worksites, resulting in a 6% year- on-year improvement in productivity across all factory divisions. In targeting a 20% improvement in productivity (compared to fiscal 2023), as called for in the medium-term management plan, we will establish the utilization of AI and digital technology to improve business quality and efficiency as a common theme for our “Pro-7” initiative, which focus on business improvement. We will aim to horizontally roll out and accelerate these initiatives from fiscal 2025. We will work on improving operational efficiency and product quality through digital verification using 3D data in design development and production technology, optimizing production line design using AI and simulation technologies, and shortening procurement lead times and stabilizing procurement through digital collaboration with our business partners.

The most important point in utilizing digital technology is to start with the mindset of asking ourselves what it is that we want to achieve, and what would be wonderful if we could do it? Since the advent of smartphones, our lives and values have changed significantly. With this kind of thinking, imagination, and creativity, we will continue to leverage digital technology to reassess our work methods and focus on improving business quality, efficiency, and productivity.

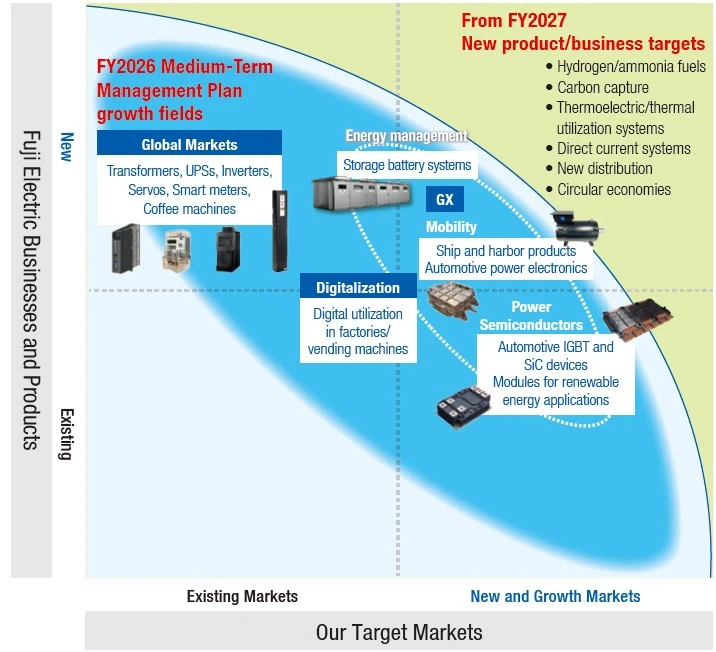

Q: Could you please explain Fuji Electric’s growth strategy and initiatives for creating new products and new businesses?

We expect global trends such as the transition to a decarbonized society, the shift toward a circular economy, and greater investments in digitalization will gain further momentum in the future. We believe that the period of the medium-term management plan through to fiscal 2026 will be an important three years in preparation for our next phase of growth. To achieve sustained growth, we will focus on strengthening and expanding the foundations of our current businesses while bolstering the development of new products in such growth fields as GX, digitalization, and global markets with the aim of realizing further business growth.

Also, as we go about leveraging the strengths and synergies of our existing businesses and technologies, we will pursue collaborations and synergies with partners in Japan and overseas to create new customer value and further contribute to solving social issues such as reducing greenhouse gas emissions and promoting a circular economy. As we look ahead to full-fledged market growth from fiscal 2027 onward, we will actively challenge ourselves to open up new fields, such as hydrogen/ammonia fuels, thermoelectric and thermal utilization systems, and direct current systems. All of these business fields have the potential to grow to a scale that can serve as business pillars in the future.

Q: What is your message for shareholders and investors?

Between the end of March 2024 and the end of March 2025, our share price indicators (PER and PBR) declined. This owed to the outlook for the semiconductor market, which we had positioned as a growth field, falling short of initial expectations, as well as weak growth in plant systems in the Energy segment and a slow recovery in demand for components in the FA components business and the ED&C components business. However, even though conditions for components, including semiconductors, will be challenging in the near term, we are confident that we can turn earnings around. We will continue to bring to market new products as planned and drive growth in the businesses we have defined as medium- to long-term growth fields. Moreover, we will provide a clearer and more thorough explanation of our future growth strategy within this business mix through constructive communication with our shareholders and investors. We will also work toward maintaining a ROIC of over 10% by executing financial and capital strategies that are mindful of capital costs.

No matter how much the times or the operating environment may change, we will continue to be a company that swiftly grasps the essence of change, demonstrates flexibility and creativity, accurately responds to the needs of society and our customers, and transforms challenges into opportunities while taking action to stay one step ahead. Essential to this is our diverse pool of human resources. Under our employee-first approach, we respect individuality and diversity, and we promote a system where each employee feels happy working at Fuji Electric and independently enhances their productivity. We are also working to create an environment where our diverse workforce can demonstrate their collective strength as a team with the aim of enhancing corporate value.