IR Information

Financial and Capital Strategies Fuji Electric Report 2025

We will sustainably enhance our corporate value by expanding profit and promoting business operations with a focus on capital costs.

Senior Managing Executive Officer

Corporate General Manager, Corporate Management Planning Headquarters

Yoshitada Miyoshi

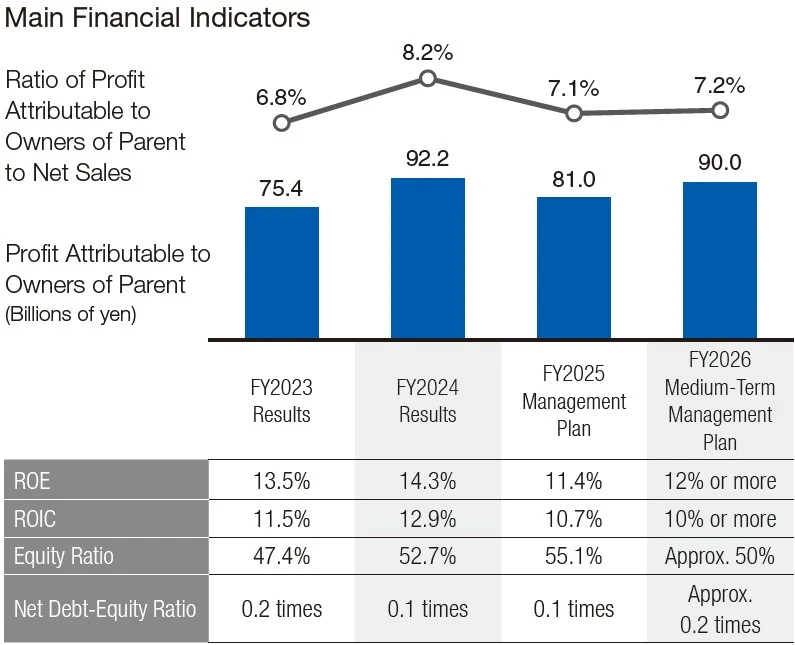

In the FY2026 Medium-Term Management Plan announced in May 2024, we adopted profit-focused management as our basic policy and established an operating profit ratio of 11% or more, a ratio of profit attributable to owners of parent to net sales of 7% or more, an ROE of 12% or more, and an ROIC of 10% or more as our key management indicators for fiscal 2026. We will strengthen ROIC management across all businesses and promote rigorous cash management, maximization of operating cash flow, and improvement of asset health.

With regard to financial discipline, we have set standards of an equity ratio of approximately 50% and a net D/E ratio of approximately 0.2 times in order to maintain a credit rating of A* or higher, which is necessary for business continuity and our ability to respond to investment opportunities.

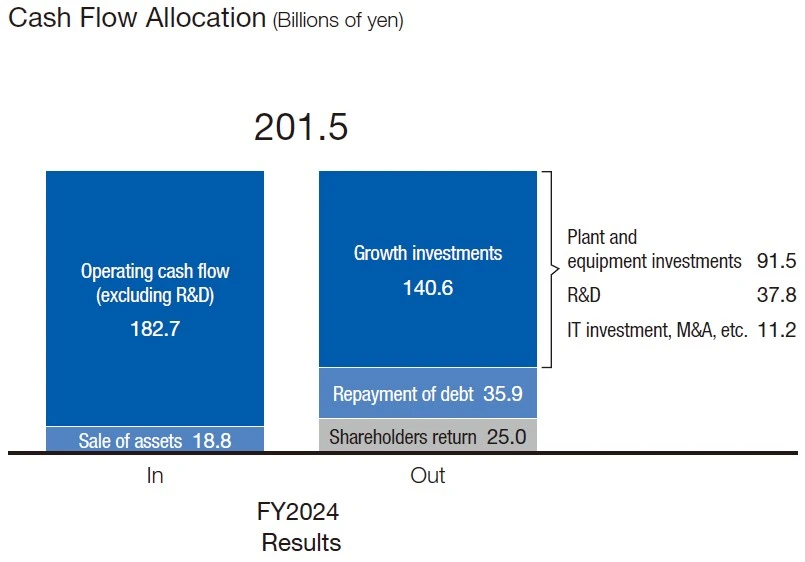

We will allocate about 90% of cash generated to investments in the growth fields of energy, industry, and semiconductors. While controlling financial leverage, we will aim to strike a balance between maintaining a stable financial foundation and making investments for growth.

As we engage in timely and appropriate communication with our shareholders and investors, we will sustainably enhance our corporate value by promoting business operations with a focus on capital costs.

Business Operations with a Focus on Capital Efficiency

Thoroughly manage per-business ROIC to strengthen profitability

Although we estimated our WACC to be approximately 8% when formulating the FY2026 Medium-Term Management Plan, we recognize that it has risen by about 1% along with the shift to a world with interest rates, and we are promoting business operations with a focus on capital efficiency in each segment. Using per-business ROIC as a management indicator, we are working to optimize accounts receivable and inventories for each business while strengthening our profitability through investment decisions that consider future profitability and business operations based on profit.

As for our business environment, the market for semiconductors, where growth is expected, remains in an adjustment phase, and we continue to face difficult decisions, such as judging the timing of growth investments. On the other hand, business opportunities related to decarbonization and digitalization are expanding.

In fiscal 2024, although we faced reduced sales volume and production for components as demand in markets such as FA and machine tools did not recover, as well as increased fixed costs and high raw material prices, all segments achieved profit growth thanks to product sales price increases from providing high-value-added products and improved productivity, resulting in an operating profit ratio of 10.5%. In addition to the improvement in operating profit, gains from the sale of cross-shareholdings led to a ratio of profit attributable to owners of parent to net sales of 8.2%, an ROE of 14.3%, an ROIC of 12.9%, and an equity ratio exceeding 50%, with financial leverage declining more than initially planned.

In FY2025, we will actively invest in the Energy and Industry segments For Semiconductors, we will make investments for the future

In fiscal 2025, for the entire company we will aim for an ROIC of 10.7% or more, which exceeds our WACC, by investing capital in the Energy, Industry, and Semiconductors segments, which are our growth fields, in order to generate profit.

For Semiconductors, although we do not expect volume expansion and profits will decrease, we will make forward- looking investments to achieve a medium-term improvement in ROIC. We will utilize older Si chip production equipment and proceed by replacing them with SiC chip production facilities (see Semiconductors, P34). We will advance development investment for full-scale operation of mass-production facilities and for 8-inch wafers, and we plan to reap the benefits of these investments from fiscal 2027.

In the plant systems business, we will work on early collection of accounts receivable and optimization of long-term dormant assets to improve our cash conversion cycle. In the Energy segment, orders are accumulating due to increased electricity demand as well as new construction and expansion of datacenters, and we have decided to invest in reorganizing and increasing production for our substation systems business and power supply and facility systems business (see Energy, P30). We will invest to increase capacity amid steady order growth and aim for further expansion of sales and profit from fiscal 2026.

In the Industry segment, we will reorganize the components business, which is susceptible to market fluctuations, into an integrated manufacturing and sales structure. We will consolidate and visualize information related to customers and production and share this information in order to accelerate management speed (see Industry, P32). We aim to further improve ROIC by optimizing production plans and reducing inventories.

Furthermore, in manufacturing, we will promote the use of digital technology across the entire company and work to improve productivity and quality as well as reduce costs, centered on the information linkage between PLM and SCM (see Manufacturing and Procurement, P42).

Cash Flow Allocation for Maximizing Corporate Value

In fiscal 2024, we used the cash generated by operating activities to make capital investments of ¥91.5 billion centered on the Energy, Industry, and Semiconductors segments; ¥37.8 billion in R&D; and ¥11.2 billion in IT investments for business transformation and funding for startups to create new products and businesses.

In fiscal 2025, while controlling the accelerator and brake for capital investment according to circumstances, we will promote R&D investment and IT investment to strengthen our competitiveness and advantages based on the Medium-Term Management Plan.

Keeping our future business portfolio in mind, we intend to make timely and concrete growth investments while utilizing financial leverage, such as through capital alliances with companies that maximize business and technological synergies, and M&A to expand our overseas businesses.

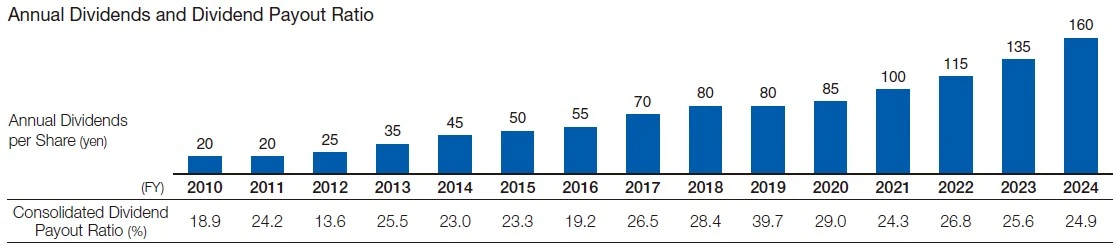

Increasing Dividends Based on a Policy of Stable and Continuous Payments

As for returning profits to shareholders, our policy is to make stable and continuous payments, taking into account the medium- to long-term business cycle. The dividend amount is determined by comprehensively considering factors such as consolidated performance for the current fiscal year, capital investment and R&D plans for future growth, and the business environment.

Under the FY2026 Medium-Term Management Plan, we aimed to achieve sustainable improvement in profitability and profit maximization by promoting our growth strategies, and set a target dividend payout ratio of approximately 30% for shareholder returns.

The dividend for fiscal 2024 was ¥160 per share, an increase of ¥25 from the previous fiscal year. We have maintained a trend of increasing dividends without any reductions since fiscal 2010.