IR Information

Semiconductors Overview of Segments Fuji Electric Report 2025

We will strive for medium- to long-term business expansion by contributing to automobile electrification, equipment downsizing, energy savings, and CO2 emissions reduction.

Corporate General Manager, Semiconductors Business Group

Toru Hosen

Market Trends and Business Opportunities

Power semiconductors, which contribute to energy savings through high conversion efficiency and power control, are experiencing increased global demand against the backdrop of environmental measures for decarbonization and rising investment in automation within the manufacturing industry.

Overview of Results

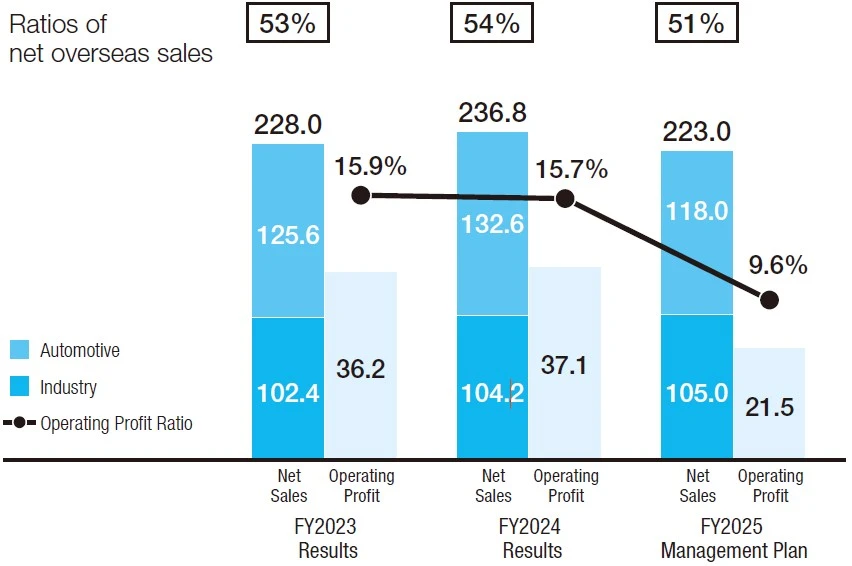

Business Performance Trends (Billions of yen)

In fiscal 2024, although demand was sluggish for overseas xEVs and for FA-related applications in Japan, net sales increased by ¥8.8 billion year on year to ¥236.8 billion. This was due to increased demand for xEVs in Japan and for renewable energy overseas, as well as sales price revisions. Operating profit increased by ¥0.9 billion year on year to ¥37.1 billion, driven by an increase in net sales and sales price revisions, despite factors such as increased costs related to production capacity expansion and the impact of high raw material prices.

In fiscal 2025, although demand for renewable energy is expected to remain strong and a moderate recovery is anticipated for FA-related applications, we plan for net sales to decrease by ¥13.8 billion year on year to ¥223.0 billion due to a decrease in sales volume for xEVs. We plan for operating profit to decrease by ¥15.6 billion year on year to ¥21.5 billion, with an operating profit ratio of 9.6%, due to the decrease in sales volume, high raw material prices, increased fixed costs, and the impact of the fiscal 2024 sales price revisions.

Priority Measures

Securing New Design Wins for xEVs and Expanding Sales of IGBTs and SiCs

We are working to develop power semiconductor module products that are even more compact, have lower generated losses, and achieve higher reliability to contribute to improving driving ranges, securing interior space, and reducing weight.

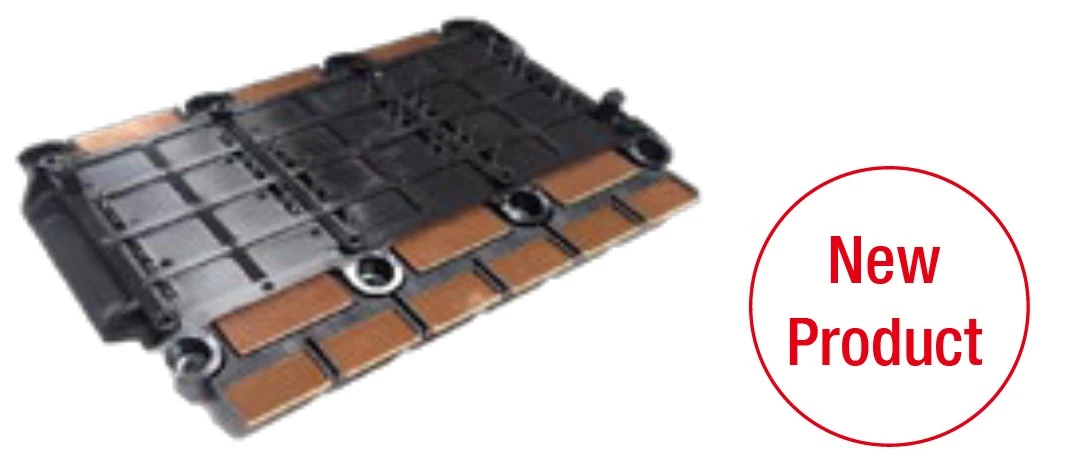

We have developed a compact RC-IGBT module that is 54% smaller than conventional products by utilizing our Si-based RC-IGBTs*1, which we developed ahead of our competitors. For SiC products, we have developed a new SiC module that is 49% smaller than conventional products by using our threedimensional wiring technology, which also significantly reduces the module’s internal inductance*2 and lowers losses. We plan to begin mass production of the compact RC-IGBT module in fiscal 2025 and of the SiC module in fiscal 2026.

Focusing on these competitive new products, we will drive their adoption in customer designs and cultivate new customers, contributing to downsizing and reducing the costs of customers’ equipment.

-

※1 RC-IGBT

-

A product that achieves significant loss reduction and downsizing by arranging two types of semiconductors with different functions (an IGBT and a free-wheeling diode) alternately in a straight line on a single chip and operating them together.

-

※2

-

A higher value here increases switching losses and noise.

New Products for xEVs

-

*

-

Comparison based on equivalent ratings. As the rated current differs from that of conventional products,comparison is based on effective module output conversion values.

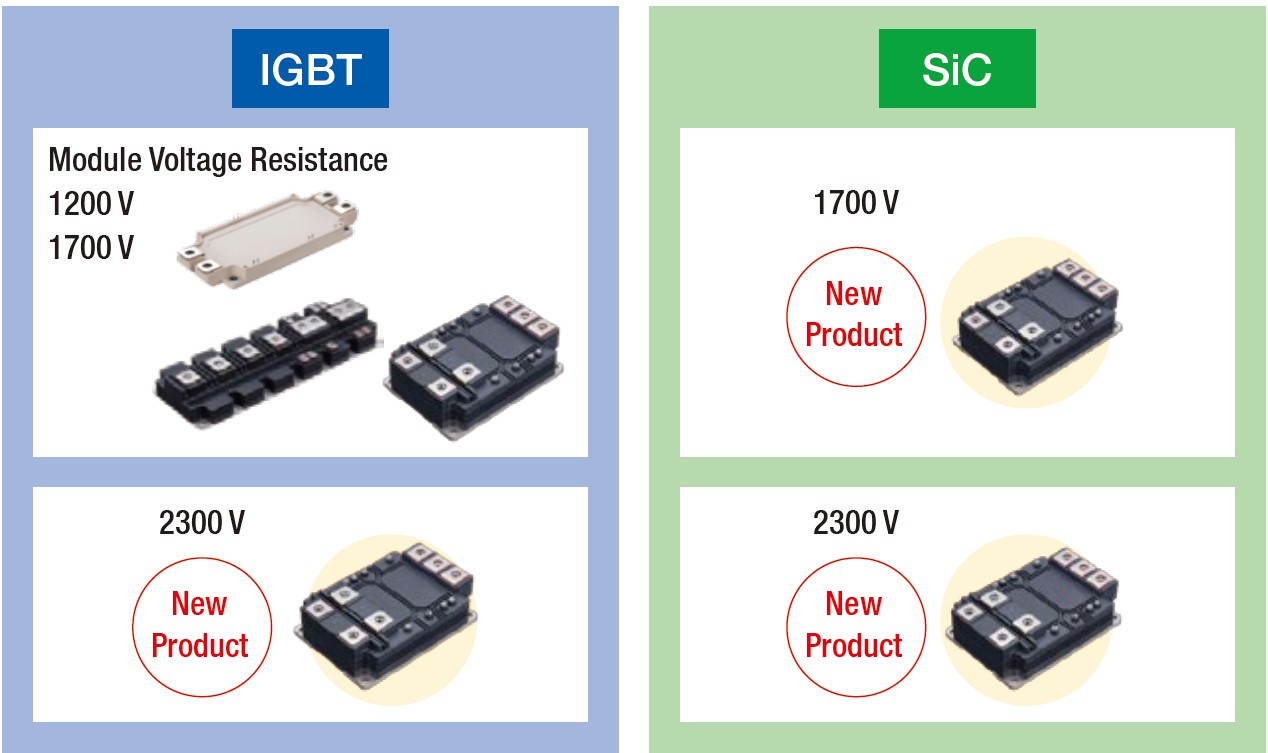

Expanding Sales, Primarily in the Renewable Energy Field

In the renewable energy field, there are growing needs for products with higher voltage ratings to increase power generation, higher reliability to ensure stable power supply, and higher efficiency that leads to smaller and lighter equipment. We are expanding our product series of IGBT and SiC modules that meet these needs and are expanding our sales.

We are also developing next-generation products for the industrial field. The 8th-generation IGBT module will reduce chip size by lowering generated losses by 15% or more compared to our current mainstay 7th-generation IGBT modules. Furthermore, we will achieve significant cost reductions through initiatives such as using shared and standardized structural

Product Lineup for the Renewable Energy Field

Strengthening Production Capacity and Starting Mass Production of New Products to Meet Demand

While controlling the pace of production capacity expansion in line with the current demand environment, we will continue to make plant and equipment investments for future demand growth and further business expansion.

For the SiC chip manufacturing process (front-end), we began full-scale mass production of 6-inch devices at Fuji Electric Tsugaru Semiconductor Co., Ltd. in December 2024. In fiscal 2025, we will strengthen production capacity by 2.5 times year on year and proceed with the construction of an 8-inch pilot line at the Matsumoto Factory.

For the Si chip manufacturing process (front-end), we will begin mass production of the 8th-generation IGBT sequentially from the end of fiscal 2025.

For the assembly process (back-end), we will begin mass production of new products, including compact RC-IGBT modules for xEVs and 7th-generation IGBT modules for renewable energy, in fiscal 2025.

Plant and Equipment Investment and R&D Expenditures

Plant and Equipment Investment

(Billions of yen)

(Billions of yen)

R&D Expenditures

(Billions of yen)

(Billions of yen)

-

-

* Figures for R&D expenditures are classified by segment according to theme and therefore differ from the figures stated in the consolidated financial report.

Key Plant and Equipment Investment Plans

-

Strengthen production capacity for 6-inch SiC devices (front-end processes)

-

SiC 8-inch pilot line

-

Strengthen module production capacity for xEVs and the industrial field

Key R&D Plans

-

Promote development of new products, such as 3rd-generation SiC-MOSFETs and 8th-generation IGBTs

-

Strengthen SiC 8-inch technology development