IR Information

Industry Overview of Segments Fuji Electric Report 2025

We will work to improve the profitability of the components business. By creating competitive components and proposing solutions, we will expand our green transformation (GX) and overseas businesses.

Corporate General Manager, Industry Business Group

Hiroshi Tetsutani

Market Trends and Business Opportunities

Overview of Results

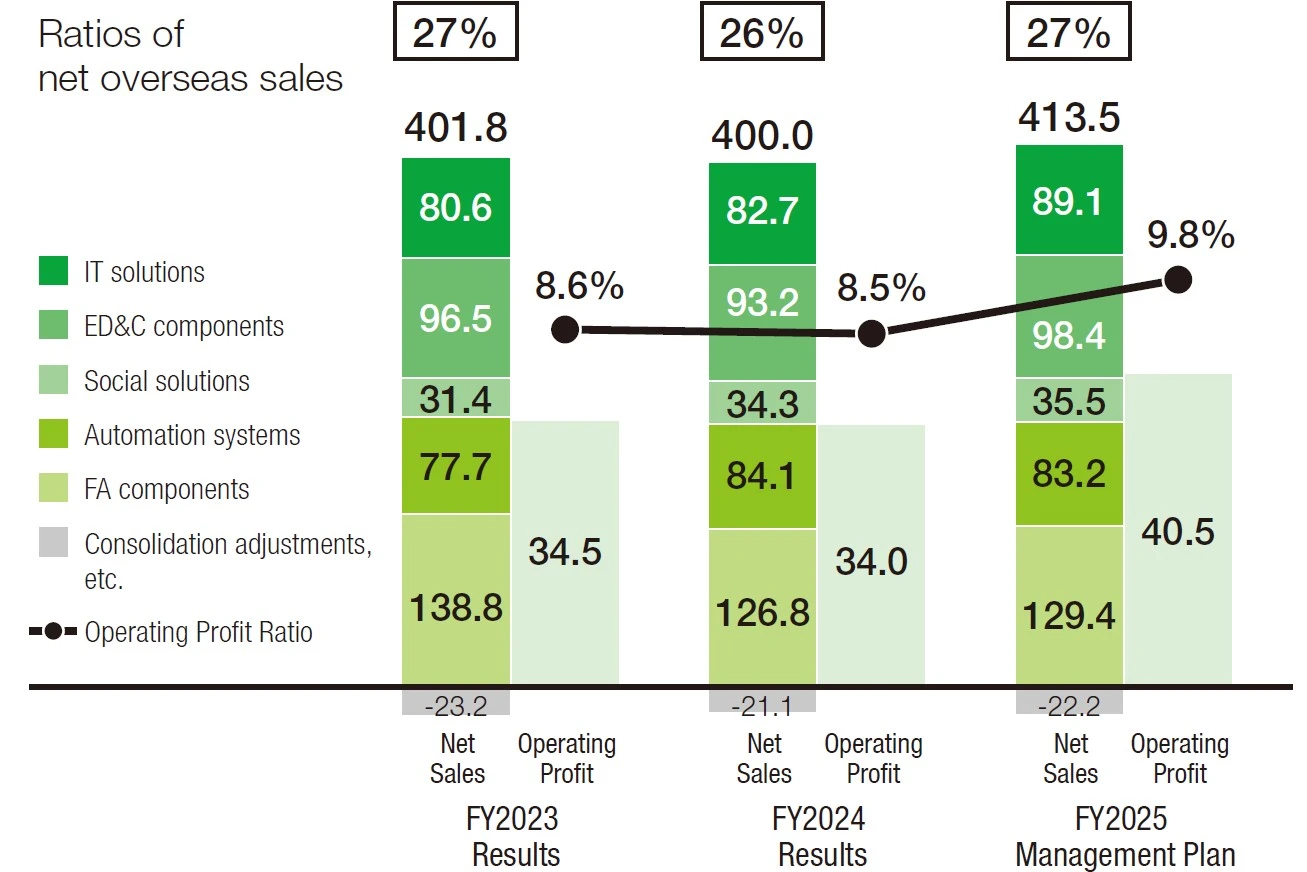

Business Performance Trends (Billions of yen)

* FY2023 results: Presented reflecting the FY2025 business reorganization (reference values calculated through a simple conversion of past figures to reflect the business reorganization)

* FY2024 results: Presented reflecting the FY2025 business reorganization

In fiscal 2024, although demand for plant system projects for the materials industry remained strong, net sales decreased by ¥1.8 billion year on year to ¥400.0 billion, while operating profit decreased by ¥0.5 billion year on year to ¥34.0 billion, which was due to inventory adjustments and decreased demand centered on low-voltage inverters in the FA components business.

In fiscal 2025, we plan for net sales to increase by ¥13.5 billion year on year to ¥413.5 billion, operating profit to increase by ¥6.5 billion year on year to ¥40.5 billion, and an operating profit ratio of 9.8%. This will mainly be driven by expanded sales and improved profitability from launching new products in the components business as well as increased demand in the ED&C components and IT solutions businesses.

Priority Measures

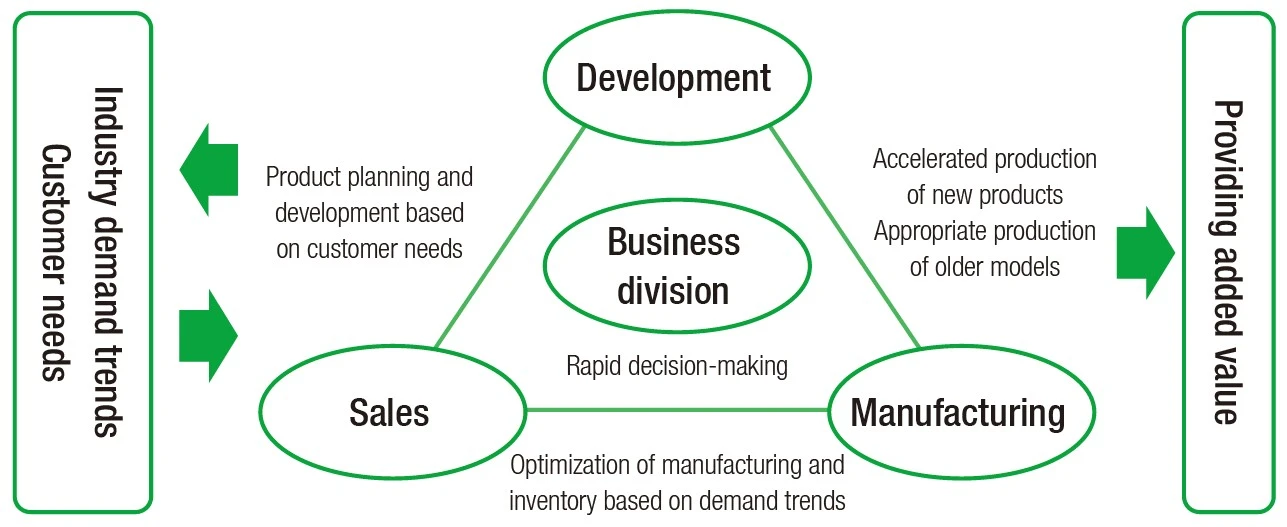

Strengthening Our Structure by Integrating

Component Manufacturing and Sales

Component Manufacturing and Sales

From fiscal 2025, we will build an organization that integrates sales, development, manufacturing, and the business division to accelerate management speed. We will improve the accuracy of demand forecasting and make rapid decisions on product planning that meets customer needs, early development of high-value-added products, and optimal manufacturing operations. Through these initiatives, we will not only provide high-value-added products to our customers but strengthen our profitable structure by expanding sales of new products, optimizing inventory, and reducing costs by consolidating and eliminating unprofitable models.

Improving Profitability by Integrating Component Production and Sales

Expansion of Overseas Businesses

In the automation business, we will expand our overseas business by developing and expanding lineup of our global products. The next-generation industrial low-voltage inverters we launched in fiscal 2024 have been praised for their space-saving and high-efficiency features, primarily for steel and harbor crane systems, and their delivery track record is increasing. In fiscal 2025, we will launch next-generation highvoltage inverters for applications such as compressors and conveyors. In addition, as a new field, we will provide largecapacity, high-voltage, water-cooled inverters for applications such as air storage and turbine electrification. We will appeal the value of energy savings and high reliability while working to expand the systems business by sharing the engineering know-how cultivated in Japan with local human resources.

Global Products

| Next-generation low-voltage industrial inverters | Next-generation high-voltage inverters | Large-capacity, high-voltage water-cooled inverters |

|---|---|---|

|

|

|

In the FA components business, we will newly enter the smart meter business in India. Although India is promoting installation of smart meters as a national policy, local competitors have had issues with quality and production capacity. By utilizing design know-how cultivated in Japan, we will secure stable production capacity through product structure design that enables automated production. Furthermore, we will newly enter the market by leveraging our strength, high quality—achieved by using components whose quality has been confirmed in Japan and by minimizing human-dependent factors through full automation. Going forward, we will strive to expand sales and profit by further enhancing our costcompetitiveness both by obtaining Bureau of Indian Standards (BIS) certification and by localizing parts for which high quality can be ensured as replacements.

Expanding Sales and Strengthening the Structure of the ED&C Components Business

For the machine tool manufacturer market, we will accelerate the switch to the new SC-NEXT series of magnetic switches and aim to capture demand for semiconductor production equipment. For the power distribution market, we will focus on new order acquisition activities for datacenter (IDC) and factory construction projects. We will also promote orders for power monitoring equipment and other products to meet demand related to carbon footprints.

In parallel, we will work to strengthen the structure of our production sites by utilizing digital technology. We will equip the fully automated assembly line for the SC-NEXT series with MES, which enables automatic acquisition of site data and a production line analysis system, to reduce costs and improve productivity.

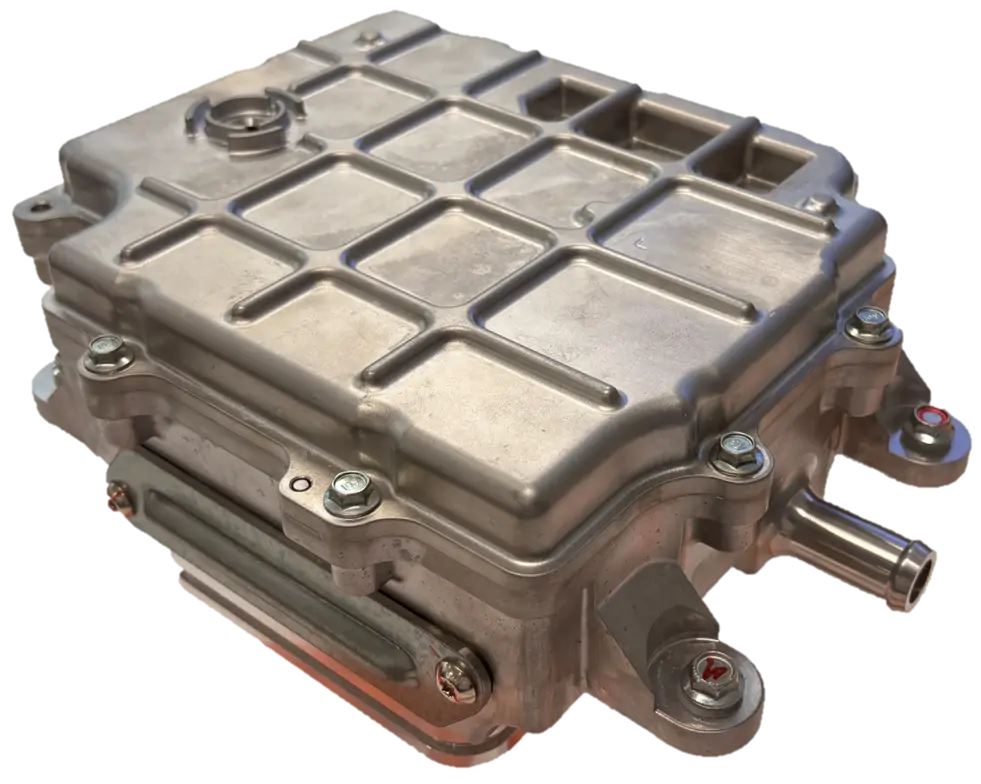

Priority Development to Capture GX Demand

We will focus our development efforts on heat products such as ejector cooling systems used for cooling AI servers in IDCs as well as on steam-generation heat pumps that can efficiently generate steam using waste heat from factories. To strengthen our medium- to long-term competitiveness, we aim for future business expansion by developing new products such as those for mobility and radiation-related equipment for overseas markets.

| Heat products | Mobility products | |

|---|---|---|

|

200kW

ejector cooling systems

|

150℃/100kW

steam-generation heat pump

|

Automotive power electronics

|

Plant and Equipment Investment

and R&D Expenditures

and R&D Expenditures

Plant and Equipment Investment

(Billions of yen)

(Billions of yen)

R&D Expenditures

(Billions of yen)

(Billions of yen)

-

-

*Figures for R&D expenditures are classified by segment according to theme and therefore differ from the figures stated in the consolidated financial report.

Key Plant and Equipment Investment Plans

-

Production equipment for products for the mobility field, smart meters, and heat products

-

Assembly automation for products in the ED&C components business

Key R&D Plans

-

Global products (servos, high-voltage inverters, radiation-related equipment, etc.)

-

Platform development (low-voltage inverters, etc.)

-

GX-related products (next-generation power equipment, heat products, mobility, etc.)