IR Information

Food and Beverage Distribution Overview of Segments Fuji Electric Report 2025

We will work to improve our profitability and build our operating foundation with new products that meet market needs.

Corporate General Manager, Food and Beverage Distribution Business Group

Keiichi Asano

Market Trends and Business Opportunities

Although the food and beverage distribution market as a whole is expected to be lower than the previous year due to the leveling off of demand related to new banknotes in Japan, needs are growing in new fields for automation, labor savings, and environmental measures, and we will work to expand our business by launching new products.

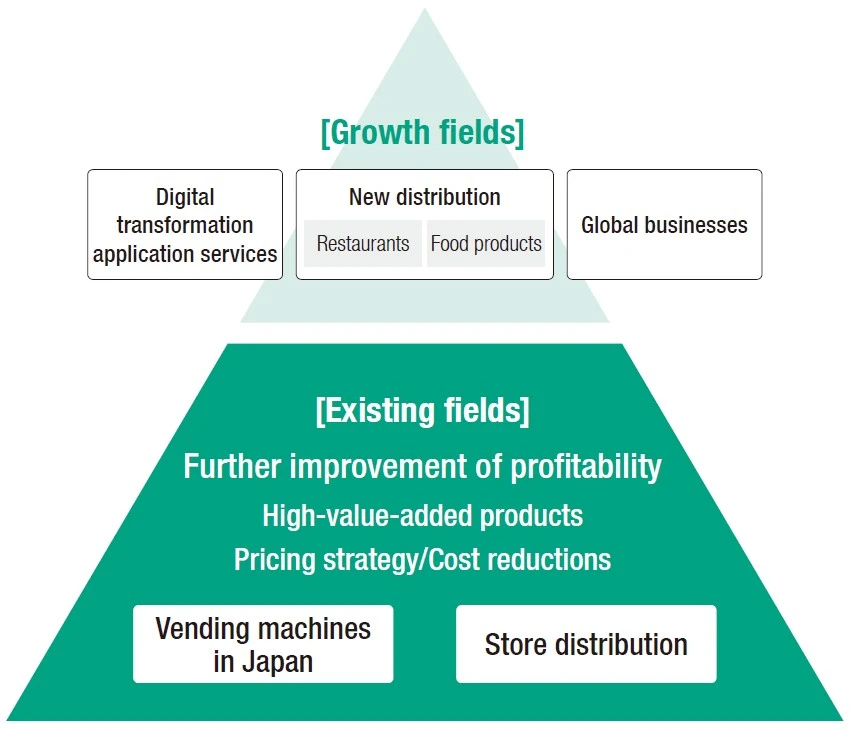

Overview of the FY2026 Medium-Term Management Plan

Overview of Results

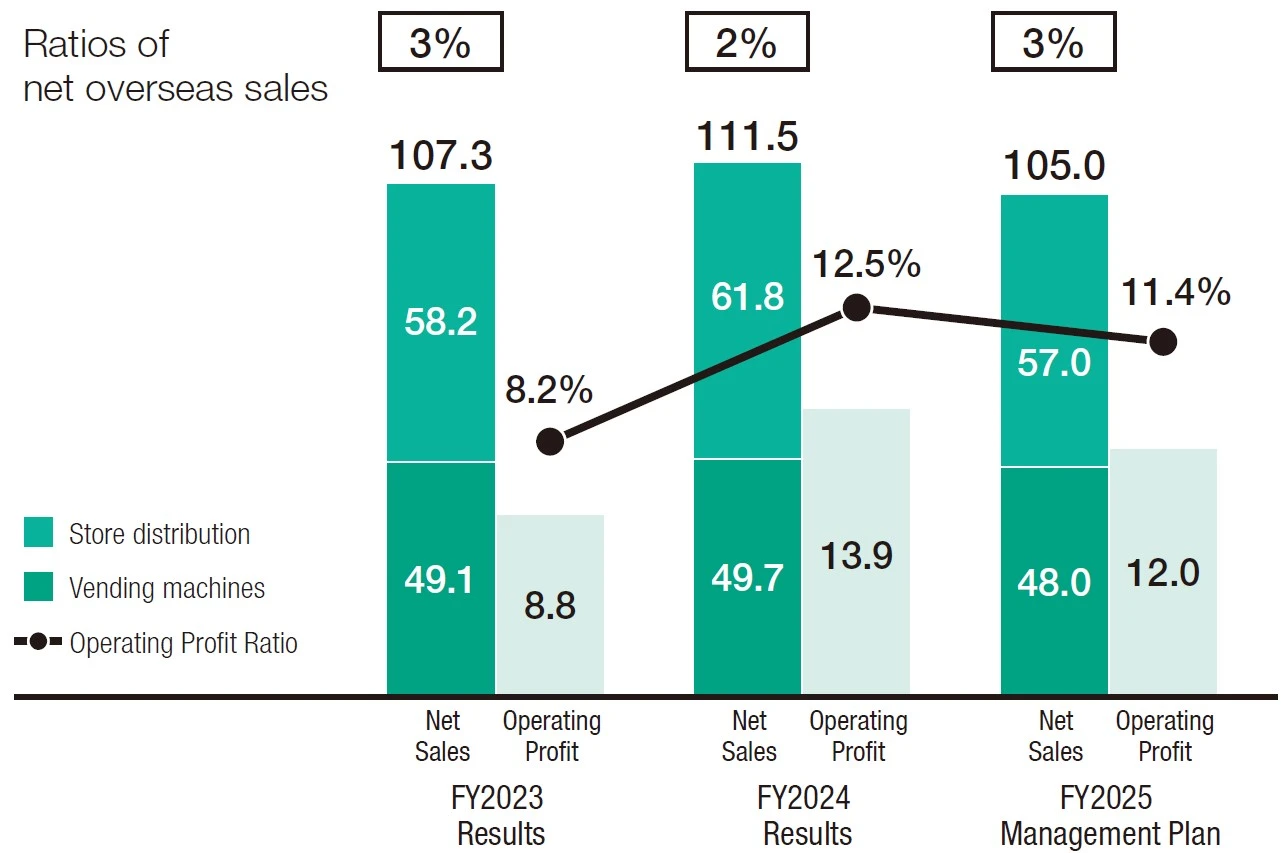

Business Performance Trends (Billions of yen)

In fiscal 2024, net sales increased by ¥4.2 billion year on year to ¥111.5 billion, while operating profit increased by ¥5.1 billion year on year to ¥13.9 billion due to increased sales volume and the promotion of cost reduction activities. This was driven by increased market share for vending machines in Japan and higher demand for automatic change dispensers in the store distribution business due to the issuance of new banknotes in Japan.

In fiscal 2025, although we will promote sales expansion measures such as growing sales of new products and further increasing our market share, we plan for net sales to decrease by ¥6.5 billion year on year to ¥105.0 billion, and operating profit to decrease by ¥1.9 billion year on year to ¥12.0 billion, with an operating profit ratio of 11.4%, due to the fall-off in demand related to new banknotes.

Priority Measures

Improving Profitability by Expanding Our Lineup of High-Value-Added Products

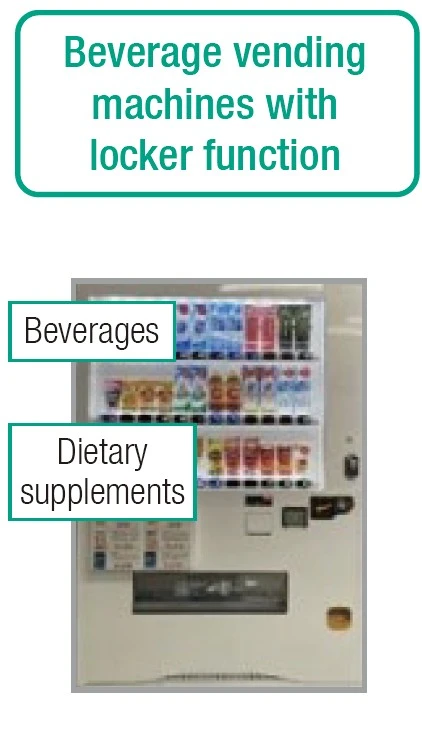

In the vending machine business in Japan, we will expand our product lineup in various locations with models that contribute to higher customer sales. These efforts include expanding the range of ultra-energy-efficient vending machines based on our “Sustainable Vending Machine,” which won the Minister of Economy, Trade and Industry Award at the Energy Conservation Grand Prize in 2023; launching PET-bottle exclusive vending machines; and offering beverage vending machine with a locker functions that can sell beverages and supplements together.

In the store distribution business, we will introduce ecofriendly showcases for convenience stores that are compatible with green refrigerants and have enhanced energy-saving performance; automatic change dispensers that save both space and labor; and new counter fixtures that address diversifying user preferences and help promote customer sales.

In manufacturing, we aim to further improve profitability by expanding use of platform designs and in-house manufacturing to reduce costs, as well as by utilizing digital technology to improve productivity.

Existing Business Areas: High-Value-Added Products

Growth areas: DX Application Services

Building the Operating Foundation (Improving Top Line Earnings)

Based on the Medium-Term Management Plan, we will position “DX application services,” “new fields,” and “global business” as growth fields and strengthen them.

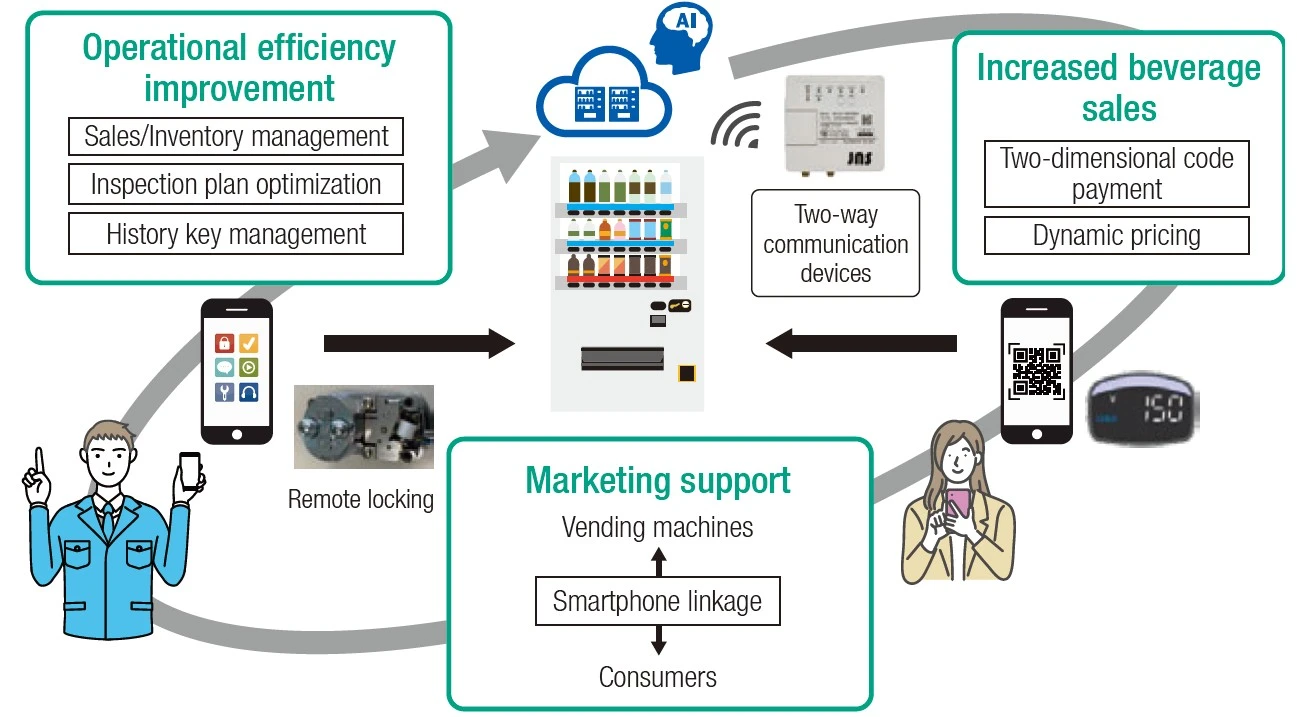

For DX application services in the vending machine business, we will enhance the value provided to customers by equipping machines with two-way communication devices. This will enable features such as dynamic pricing (to flexibly change prices according to demand trends), support for smartphone payments, and services that improve the efficiency of vending machine operations. In the store distribution business, we will promote services that contribute to optimizing store operations and reducing environmental impacts, such as visualizing energy consumption based on the store controller and coordinating the operation of showcases and air conditioning equipment. In fiscal 2025, we will conduct demonstration experiments with customers and promote activities to secure design wins.

Regarding new fields, we will collaborate with coffee equipment trading companies to accelerate design wins with restaurant and cafe chains for our coffee machines for restaurants, which we launched last fiscal year. To expand orders, we will emphasize the value provided by automation, high-quality taste, and maintenance-free operation. In addition, the locker vending machine we launched in fiscal 2024 allows users to freely select products of various sizes and enables 24-hour sale of refrigerated goods; we will expand its sales, targeting new markets that involve fresh produce, Westernstyle confectionery, and agricultural products.

For our global business, we aim to newly enter the vending machine market in India. In China and Southeast Asia, in addition to conventional vending machines, we will offer global coffee machines to respond to the expanding coffee market as well as ice cream vending machines for the ice cream market, which is seeing remarkable growth.

Going forward, we will anticipate social changes and contribute to the sustainable improvement of our top line earnings as well as the enhancement of our corporate value.

Growth areas: New products in the vending machine and store distribution businesses

Plant and Equipment Investment and R&D Expenditures

Plant and Equipment Investment

(Billions of yen)

(Billions of yen)

R&D Expenditures

(Billions of yen)

(Billions of yen)

-

-

*Figures for R&D expenditures are classified by segment according to theme and therefore differ from the figures stated in the consolidated financial report.

Key Plant and Equipment Investment Plans

-

Investments to improve productivity (rationalization, automation, and in-house manufacturing)

-

Environmental investments to reduce CO2 emissions at manufacturing bases

Key R&D Plans

-

High-value-added vending machines, eco-friendly showcases

-

DX application services and products for new fields