Management Information

Medium-Term Management Plan

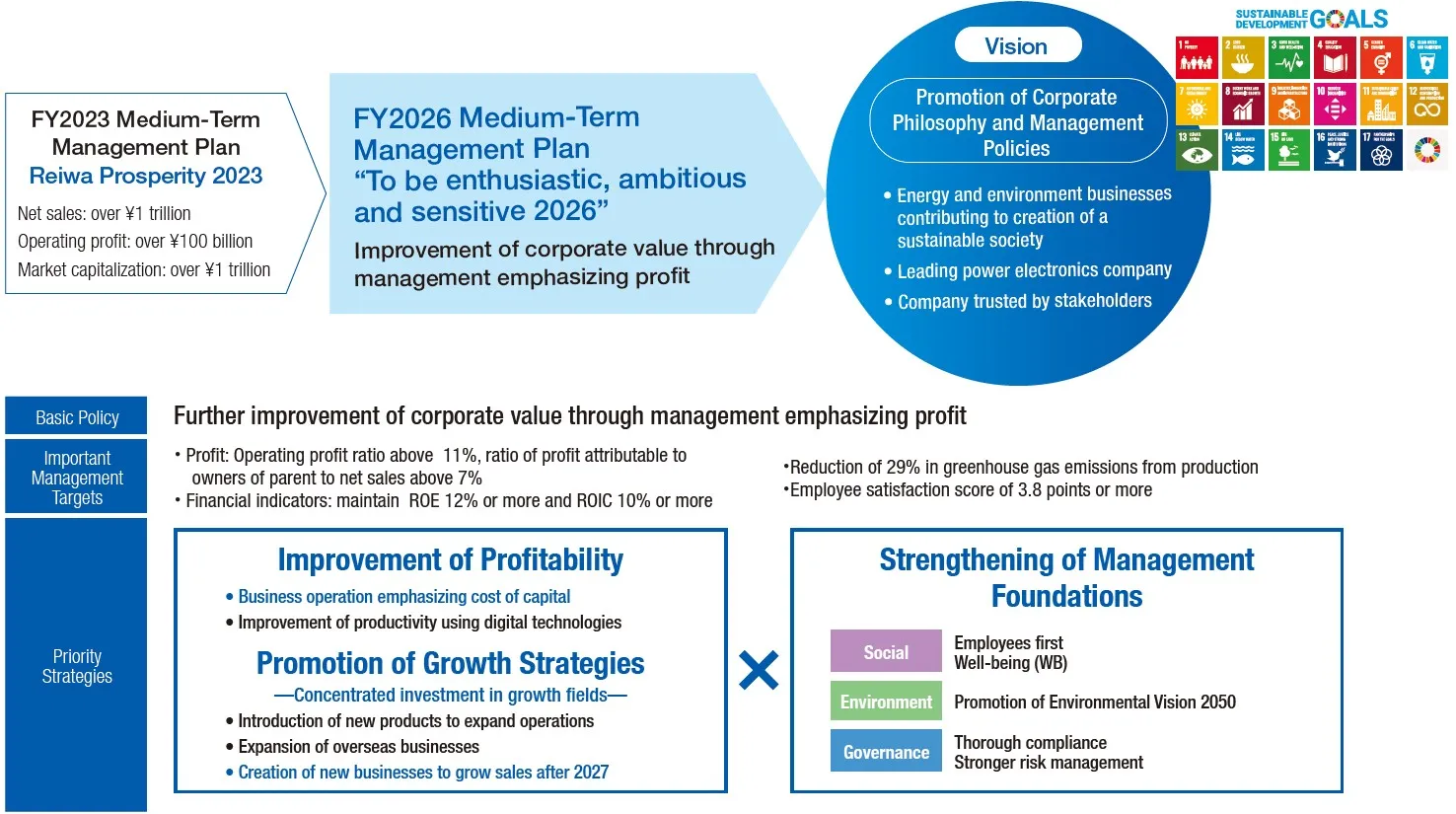

FY2026 Medium-Term Management Plan "To be enthusiastic, ambitious and sensitive 2026,"

We have formulated and launched our three-year medium-term management plan, "To be enthusiastic, ambitious and sensitive 2026," which covers the period from fiscal 2024 to fiscal 2026.

Basic Policy and Priority Strategies

In pursuit of embodying our corporate philosophy and management policies, we aim to play a role as a leading company in power electronics, contributing to the realization of a sustainable society through our energy and environment businesses. Our goal is to continue to be a company that is trusted by all our stakeholders, including our employees, shareholders, and business partners. In the FY2026 Medium-Term Management Plan, we return to the core of our management principles under the corporate slogan "To be enthusiastic, ambitious and sensitive." As we adapt to the changing times—such as accelerating the transition to a decarbonized society and the advancement of digitalization—we are committed to improving profitability, promoting growth strategies, and strengthening our operating foundation to support sustainable growth in corporate value. Our basic policy is to improve corporate value through management emphasizing profit. This involves not only focusing on operating profit (ratio) but also placing emphasis on profit attributable to owners of parent (or its ratio to net sales) and managing with an awareness of capital costs. The cash generated through this approach will be directed toward growth investments.

Performance and Financial Targets

For fiscal 2026, we aim to maintain an operating profit ratio of 11% or more, ratio of profit attributable to owners of parent to net sales of 7% or more, an ROE of 12% or more, and an ROIC of 10% or more. By segment, we plan to achieve growth and expand profits in the Energy, Industry, and Semiconductors segments. While all segments had an operating profit ratio surpassing 8% in fiscal 2023, we are targeting a margin of 10% or more across all segments by fiscal 2026. In addition to building a robust business portfolio, we will further enhance synergies between business divisions to effectively respond to changes in the market.

Promotion of Growth Strategies

Business expansion through new product launches

We will introduce new products in growth areas such as green transformation (GX), digital transformation (DX), and global markets.

GX

In the Energy segment, we will strengthen our proposals for integrated solutions, including electricity storage systems, energy management systems (EMS), and renewable energy-related products. In the Industry segment, we will launch new products in the mobility field. Additionally, in the Semiconductors segment, we will focus on full-scale production of silicon carbide (SiC) products, primarily those for electrified vehicles (xEVs).

DX

In the Industry segment, we will promote the market launch of digital transformation solution products. In the Food and Beverage Distribution segment, we will work on developing new service businesses that leverage digital technologies.

Global

In the Energy and Industry segments, we will speed up the introduction of global products to the market.

| Food and Beverage Distribution | New Distribution Fields | Promotion of digital transformation of vending machines and stores |

| Semiconductors | Power Semiconductors | Growth of renewable energy and electrified vehicle markets Increased SiC device production |

| Industry | Digital transformation solutions | Promotion of global smart factories |

| Mobility | Launch of new ship and harbor (electrified) products Commercialization of automotive power electronics |

|

| Global Products | Global, compact low-voltage inverters and drives | |

| Energy | Energy Management | Comprehensive renewable energy proposals (electricity storage, EMSs, renewable energy) New product development and product function enhancement |

| Global Products | Vacuum circuit breakers (VCBs), molded case transformers, and large-capacity uninterruptible power systems (UPSs) |

Expansion of Overseas Businesses

With a focus on local production for local consumption, we are working to introduce global products and implement region-specific priority measures.

Asia, India, etc.

Power demand and needs for renewable energy and energy saving are expanding, particularly in industries such as power companies, steel, harbors, and chemicals. In response, we are focusing on expanding substation systems for industrial fields within the energy management business, as well as increasing sales of inverters, small-capacity power supplies, and measuring instruments, and expanding systems for harbor cranes in the automation business. In India specifically, we aim to increase sales by approximately 1.4 times by entering the smart meter market, which is driven by growing power demand, and expanding sales of systems for steel plants.

China

We are working to expand the semiconductor business for renewable energy and growing the automation business by promoting collaboration with local companies to increase sales of industrial inverters and induction furnaces.

Europe

We are focusing on expanding the semiconductor business for renewable energy and growing the automation business by increasing sales of inverters for elevators.

Americas

We are primarily focused on business expansion in the geothermal power generation field within the power generation business.

Concentrated Investment in Growth Areas

We will continue to focus investments in the growth areas of energy, industry, and semiconductors. Of the total plant and equipment investment of ¥254 billion planned over the next three years, 96% will be directed toward these growth areas. Similarly, 82% of the ¥130 billion allocated to R&D expenditures will be focused on these fields. In plant and equipment investment, we will prioritize expanding semiconductor production capacity while increasing environmental investments. In R&D, we will concentrate on developing new products and creating new businesses related to the green transformation market.

* The research and development expenses are categorized according to themes, and differ from the figures listed in the financial statements.

Improvement of Profitability

Improving productivity through digital technologies

By leveraging digital and AI technologies to enhance our production technologies, we aim to improve productivity and quality as well as to reduce costs. We plan to boost productivity by 20% by fiscal 2026 compared to fiscal 2023, thereby enabling us to meet the increased sales volume associated with business expansion in growth areas.

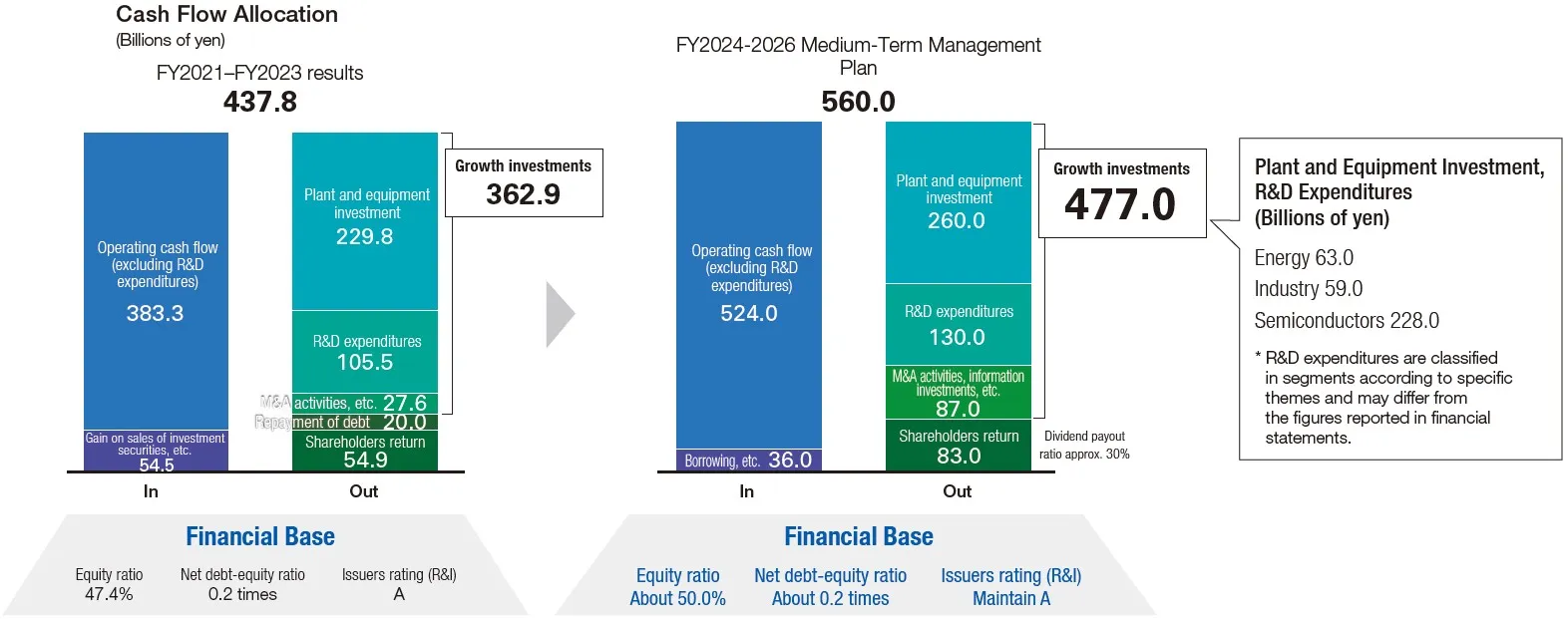

Balanced Cash Flow Allocation Focused on Growth Investments

In our FY2026 Medium-Term Management Plan, 90% of the cash generated will be allocated to growth investments, representing an increase of 1.3 times compared to the previous three years. Along with plant and equipment investments and R&D in growth areas, we plan to pursue M&A activities and IT investments. Regarding shareholder returns, we maintain a basic policy of continuing to pay a stable dividend, targeting a payout ratio of approximately 30%. In preparation for business expansion and sustainable corporate value growth beyond fiscal 2027, we will continue to drive growth investments while aiming for a 50% equity ratio and a 0.2 times net debt-equity ratio, striking a balance between a stable financial foundation and growth potential.