Management Information

Message from CEO

By pursuing our corporate

philosophy and management policies,

we aim to contribute to the sustainable improvement of

corporate value and the realization of a sustainable society

Chairman of the Board and CEO

Michihiro Kitazawa

Fuji Electric’s reason for existence in society

Since our founding in 1923, we have exhaustively refined and evolved our energy and environmental technologies, leveraging our core strengths in power semiconductors and power electronics. We have continued to provide products that contribute to the creation of clean energy, stable energy supply, energy savings, and automation in the industrial and social infrastructure sectors. At the core of this is our corporate philosophy. Our mission, as a responsible corporate citizen in a global society, is to value and deepen our relationships of trust with communities, customers, and partners and contribute to prosperity, encourage creativity, and seek harmony with the environment. Guided by a set of management policies that embody this corporate philosophy, we aim to contribute to society through our energy and environment businesses. As we work toward achieving decarbonization—a major challenge for modern society—the business opportunities for us are expanding. We will endeavor to enhance our corporate value by contributing to value creation at our customers through the development of products that meet their needs, adding engineering services that combine these products, and providing system solutions. To achieve this, it is imperative that we leverage the collective strength of teams made up of diverse talent. We will pursue corporate growth through global business expansion and continue to contribute to the realization of a sustainable society.

Our aspirations for the Medium-Term Management Plan “To be enthusiastic, ambitious and sensitive 2026”

Our three-year Medium-Term Management Plan, which carries the title “To be enthusiastic, ambitious and sensitive 2026,” will end in fiscal 2026. It reflects our commitment to return to the fundamentals of management after achieving our long-held goals of ¥1 trillion in net sales and an operating profit ratio of over 8% in the previous medium-term management plan. It demonstrates our intention to set lofty targets and challenge ourselves as a team. In terms of KPIs for the FY2026 Medium-Term Management Plan, in addition to the existing targets of net sales, operating profit (ratio), and ROE, we have added profit attributable to owners of parent (and its ratio to net sales) and ROIC with the aim of driving profit-generating business growth. Given the mounting uncertainties right now, I do not believe that investments related to the environment will continue unabated. While achieving our numerical targets is obviously important, I believe that the most crucial aspect over the next three years will be to lay the groundwork for new core businesses that can drive growth beyond 2030. Our target for the time being is to maintain a ROIC of over 10%, exceeding our weighted average cost of capital (WACC). In fiscal 2021, we introduced ROIC targets for each business to function as internal management indicators. They have helped us visualize accounts receivable- trade and inventory and embedded business operations that are mindful of capital costs. As we conduct a style of management that is conscious of the cost of capital and redirect the cash generated toward growth investments, we will generate profit growth and further enhance corporate value with a robust business portfolio. To that end, I believe that the development and retention of personnel is essential. We will restructure the frameworks and compensation systems that enable a diverse workforce to thrive, facilitating the creation of a more dynamic team where employees can challenge themselves with ambitious goals.

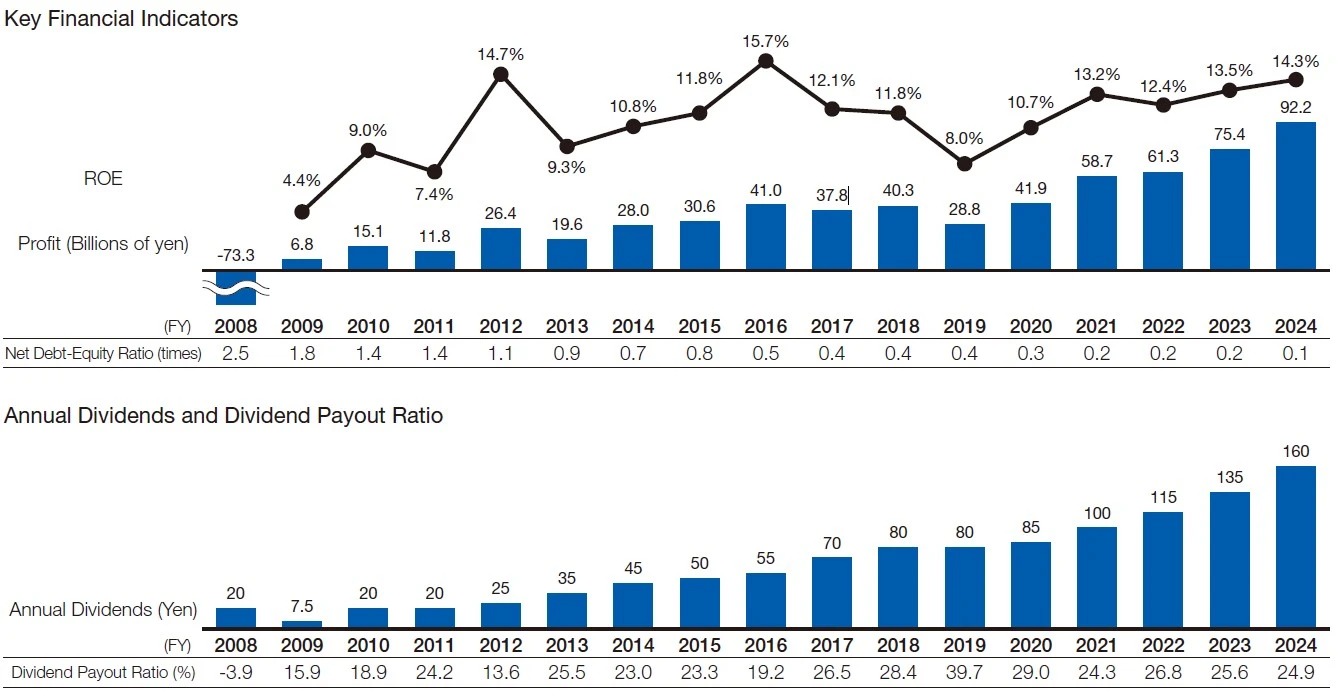

Record-high net sales, operating profit, and profit in fiscal 2024; operating profit ratio of more than 10% also achieved

The operating environment surrounding the Company has changed significantly since the first year of the FY2026 Medium-Term Management Plan. The xEV market, which has rapidly expanded until now, has seen a sharp decline in demand from US and European customers, while the supply-demand balance in the FA and machine tool sectors has been disrupted since the end of the COVID-19 pandemic, leading to stagnation due to prolonged inventory adjustments resulting from excess orders. On the other hand, investments in manufacturing and data centers aimed at decarbonization and digitalization have remained firm. Under these circumstances, in fiscal 2024 we reported record-high net sales, operating profit, and ordinary profit, while the operating profit ratio topped the 10% mark for the first time. This growth in earnings owes to our ability to continuously secure orders from key customers in the Energy segment for power supply and facility systems for use at data centers, thereby improving our productivity. Contributions have also come from our development of new products compatible with larger-capacity equipment and the introduction of power supply testing equipment. In the Industry segment, we have been able to capture equipment upgrade demand by building relationships of trust through after-sales services for existing customers in the automation business. In addition, we are beginning to see results from our local production for local consumption approach in India. On the other hand, in the FA business, we still need to reflect on our delayed response to the slow recovery in demand for components. In the Semiconductors segment, we focused on leveraging our on-site capabilities to maximize profits, primarily by slashing investment costs through the effective utilization of existing silicon (Si) production equipment in the construction of silicon carbide (SiC) production lines. In the Food and Beverage Distribution segment, we successfully tapped demand by developing high-value-added products, including those that support ultra energy efficiency, and by responding to special demand (owing to redesigned banknotes) for automatic change dispensers through the development of new identification technologies. To reduce our cross-shareholdings, we sold off some shares, the gains on which were recorded as extraordinary income, but even after stripping out this impact, we still posted record-high profit. In fiscal 2024, ROE was 14.3% and ROIC was 12.9%, which indicates that our capital efficiency has improved. This achievement owes to the efforts of every employee who challenged themselves to meet their targets, as well as the collective strengths of the team. We rewarded our employees directly in the form of bonuses. Based on this stronger profit structure, and in line with our basic policy of paying stable and continuous dividends, we have decided to raise the dividend per share to ¥160, which is an increase of ¥25 per share, or approximately 19%, compared to last fiscal year.

In fiscal 2025, we will press ahead with our growth strategy by strengthening collaboration between businesses and creating synergies; in the Semiconductors segment, we will execute contrarian investments

As demand for energy increases, driven by investments in green transformation (GX) aimed at achieving a decarbonized society and the expanded uptake of generative AI and digital technologies, we will target further improvement in our corporate value by strengthening collaboration between our businesses and advancing growth strategies through the creation of synergies. In fiscal 2025, we reorganized our business segments. In the Energy segment, we will pursue synergy effects through integrated operations with Fuji Electric Engineering & Construction Co. Ltd., a plant construction company that we made a wholly owned subsidiary last fiscal year, with a view to bolstering our work site capabilities and strengthening our plants and systems. In the Industry segment, we will look to accelerate the speed of management through the integration of production and sales in the FA components business, provide products that accurately meet customer needs, and optimize manufacturing and inventory based on demand trends. Meanwhile, in the Semiconductors segment, even though the EV market has currently plateaued, we believe that demand for vehicle electrification will expand over the longer term. We will collaborate closely with our customers to ensure that we do not misjudge the time to respond to changes in demand. Even in challenging times, we will execute contrarian investments and prepare for the period beyond fiscal 2027.

Making environmental contributions with an aggressive GX strategy

Worldwide, the effective utilization of limited resources in a circular economy is considered a key issue, and initiatives for transitioning to decarbonization and a circular economy across the supply chain are already in motion. In April 2025, we reorganized the SDGs Promotion Committee and renamed it the Sustainability Committee as a committee at the executive officer level to plan and promote key issues in business strategies. As to the environmental initiatives implemented thus far across the supply chain, in addition to decarbonization efforts such as reducing CO2 emissions, we have established a new aggressive GX product strategy team that aims to deliver environmental contributions through our products. What is important for us is to build a green supply chain based on mutual understanding with our customers and business partners regarding the many existing rules around CO2 reductions and the ecological design regulations gaining traction in Europe, for example, and to connect it to our business as an aggressive management approach. Alongside the formulation of the GX strategy, we will inject resources into new product development and the creation of new businesses. Furthermore, from the perspective of biodiversity, we will begin examining the risks and opportunities related to natural capital with reference to the Task Force on Climate-related Financial Disclosures (TNFD), and incorporate the results into our climate change action. Also, the findings of the Sustainability Committee are reported to the Board of Directors to be discussed from multiple angles. From those discussions, the committee has received feedback emphasizing the importance of understanding customer needs in response to these changes, as well as being mindful of the potential for these needs to connect to our business.

Pursuing employee happiness with employee-first management

Human resources are the source of enhancements in corporate value. I believe that management’s unwavering commitment to an employee-first approach is indispensable to the Company’s growth. On the other hand, considering our labor composition and labor shortages, the challenge for our next phase of growth will be the effective utilization of our limited human resources. We will restructure our compensation system to ensure high levels of satisfaction based on roles, regardless of age or years of experience, and we will implement mechanisms and initiatives in an effort to further improve productivity and the quality of operations. In addition, as the business environment changes and societal and personal values become increasingly diversified, it is essential that we promote diversity, for example, by empowering female and senior employees, and that we also provide stronger support to various working styles tailored to different lifestyles and life stages, as well as career paths and career development, in order to build a flexible and strong organization centered on a diverse workforce. Through these reforms, we aim to sustain a positive cycle of employee happiness (well-being) and the sustainable growth of the Company. As for efforts to strengthen Human Resources measures for the purpose of expanding our overseas operations, this issue has also been raised by outside directors at Board meetings. As such, we are reinvigorating the development of global talent and are beginning to focus on cultivating management personnel aimed at making local operations more independent. We are systematically nurturing personnel that have the potential to become executive officers in the future, and we currently have around 50 individuals in our talent pool. We want our managers—who will take charge of management and business responsibilities in the future—to have a deep understanding of Fuji Electric. We want them to gain experience across multiple roles, business divisions, and overseas bases, and to experience management of affiliated companies and key missions whenever possible. In the annual next-generation management training, opportunities are provided to participants to reassess what kind of Company Fuji Electric is through various assignments. This includes tasks focused on creating added value connecting different businesses, identifying the seeds of new businesses, understanding what kind of talent will be needed, and considering how Fuji Electric is perceived from the outside, all with a 10-year outlook. We hope that they will acquire skills from a management perspective and a high vantage point, while also building valuable relationships with colleagues with whom they can discuss pretty much anything, ultimately becoming a team that aims for greater heights.

Enhancing the effectiveness of governance for long-term corporate value improvement

For management, it is important that we enhance the transparency and effectiveness of governance in order to achieve long-term corporate value improvement. Last year, when we made Fuji Electric Engineering & Construction a wholly owned subsidiary, the Board of Directors engaged in candid discussions to make decisions on improving corporate governance, chiefly by creating synergies that contribute to further business growth in plant systems, utilizing human resources, and eliminating the risks associated with parent- subsidiary listing issues and conflicts of interest. We believe that insights based on the wide-ranging experiences of outside directors and outside Audit & Supervisory Board members will become increasingly important for corporate growth in today’s highly unpredictable world. We will increase opportunities for honest discussions, including those from worksites, without being bound by formalities, and build a stronger management structure. Moreover, constantly making preparations to counter various risks and enhancing our resilience are important. We are particularly focusing on strengthening management across the entire Group, including our overseas subsidiaries, and bolstering supply chain measures from a BCP perspective, such as developing business continuity plans in readiness for natural disasters triggered by climate change, and adopting information security measures, including those that can thwart cyberattacks. In fiscal 2024, we introduced a performance-related share- based remuneration plan for standing directors and executive officers that more clearly links their compensation to the value of the Company’s shares. We will look to manage the business in a way that further enhances an awareness of the value of the Company’s shares. Since fiscal 2010, we have continued to raise the amount of dividends paid to shareholders. We will continue with R&D, capital investments, and human resources development from a medium- to long-term perspective, maintain a balance between the Company’s growth and financial soundness, and aim to provide stable and continuous returns to shareholders with a dividend payout ratio of approximately 30%. Going forward, we are committed to paying a dividend that exceeds the previous fiscal year.

Fuji Electric’s DNA

Our corporate slogan, “To be enthusiastic, ambitious and sensitive,” represents the Company’s DNA that we want employees to cherish and pass on to future generations of employees. Enthusiasm means the eagerness to contribute to society by creating new technologies and products. Ambition means the determination and spirit to set high goals to share with the team and continuously pursue them. Sensitivity means the kindness to appreciate and care for our customers, colleagues, and families, which is exactly the Fuji Electric DNA that our predecessors have built up and passed down to us. This is what makes the team stronger. To maintain high aspirations and goals, it is necessary for the leaders themselves to maintain that same attitude and always share the big goals with the team. We will evolve our energy and environment businesses together with our customers and business partners, contribute to solving social and environmental issues and creating value for customers, and continuously improve our corporate value. We look forward to the continued understanding and support of all shareholders, including shareholders and other investors.

Chairman of the Board and CEO

September 2025

-

Note: This page contains the Message from the Chairman of the Board and CEO in the Fuji Electric Report 2025.

-