Sustainability

Disclosing Climate-related Information based on TCFD Recommendations

Since expressing our support for the Task Force on Climate-related Financial Disclosures (TCFD) in June 2020, Fuji Electric has been continuously providing disclosures aligned with TCFD recommendations. In June 2024, we re-evaluated our “risks, opportunities, adaptation measures, and financial impacts” related to the 1.5°C Scenario, in conjunction with the revision of measures aimed at achieving the targets set out in our Environmental Vision 2050 and FY2025 Mid-term Management Plan. We have also incorporated the promotion of the circular economy into our strategies and have estimated and reflected additional environmental investments required to support these initiatives.

Furthermore, in the 4°C Scenario, we are advancing our measures to address flood risks caused by extreme weather events. Beyond reviewing the allocation of our inventory and developing site-specific timelines for our business facilities, we have also completed physical measures at production sites identified as at risk—such as installing flood protection panels—to better prepare for potential inundations.

(Summarized by Fuji Electric based on the Recommendations of the Task Force on Climate-related Financial Disclosures (Final Report))

-

June 2020: Endorsement of TCFD recommendations. In addition, disclosure on “Governance” in the disclosure requirements.

-

June 2021: Disclosure on “Risks and Opportunities” (2°C/4°C target base) in the “Strategy” disclosure requirements.

-

March 2022: Disclosure on same “Risks and Opportunities” (1.5°C/4°C target) and “Adaptation Measures.”

-

June 2023: Specific identification of significant “Risks” and disclosure of countermeasures and financial impact

-

June 2024: Disclosure of updated “risks, opportunities, adaptation measures, and financial impact” for the 1.5˚C Scenario

-

June 2025: Disclosure of updated “risks, opportunities, adaptation measures, and financial impact” for the 1.5˚C and the 4˚C Scenario

Governance

Disclosed in June 2020

Updated in August 2025

Fuji Electric positions global environmental protection initiatives as a priority issue for management. We have established the Sustainability Committee, a company-wide body composed of managers, including Executive Officers, from our various business, sales, and corporate departments. The Committee discusses sustainability issues and evaluates related measures, including those related to climate change.The results of deliberations and evaluations by the Committee are reported to the Executive Committee* and the Board of Directors and discussed as necessary.

Through the promotion of Environmental Vision 2050, we will analyze the risks and opportunities that climate change poses for our business and value chains together with the financial impacts of these risks and opportunities, and we will incorporate them into our management strategy and proactively disclose the information.

In 2024, we held the Sustainability Committee twice—in May and December—and reported the deliberation results to the Executive Committee and the Board of Directors.

[Key Environment-related Topics of Discussion for the Sustainability Committee]

- Measures to achieve decarbonization goals (FY2030) and a greenhouse gas emission reduction plan

- Transitioning to environmentally friendly products

-

*

-

Executive Committee: Deliberates and reports on important management issues as an advisory body to the President.

Strategy

Disclosed in June 2020

Updated in June 2025

Among the “Risks and Opportunities” under the “4°C scenario” and “1.5°C scenario,” we specifically identified the significant risks in both scenarios and discussed the measures to be taken and the financial impact.

IEA: International Energy Agency

IPCC: Intergovernmental Panel on Climate Change

Risks indicated in bold are those we recognize as having a particularly significant impact on business.

-

Note

-

Flood risk assessments were carried out by Tokio Marine DR Co., Ltd., and subsequently subjected to in-house reviews

Sites were assessed as “at risk of flooding” in the following cases:

a) They are located in areas which publicly available hazard information states are at risk of a maximum inundation height of 0.5 meters or more

b) They are located in areas where there is no publicly available hazard information, and which are deemed due to topographical and other factors to be at high risk of flooding

TOPICS

Strengthening measures against wind and flood damage during extreme weather events

Fuji Electric is enhancing its measures against wind and flood damage associated with the increasing frequency of extreme weather events. At the Mie Factory, the main production facility of our Food and Beverage Distribution Business Group, we installed and began operating flood barriers in March 2024. Although the maximum expected flood level at the Mie Factory during emergencies is less than 0.5 meters, there is a risk of water inflow in certain areas. Therefore, we have installed a flood barrier at one of the three gates (the south gate) where the risk is present. In addition to these physical measures, we are also advancing software-based countermeasures. As part of this effort, we have developed a "Flood Response Action Timeline." We are preparing to ensure that necessary disaster prevention actions can be taken according to procedure when the need arises.

Risk Management

Disclosed in March 2022

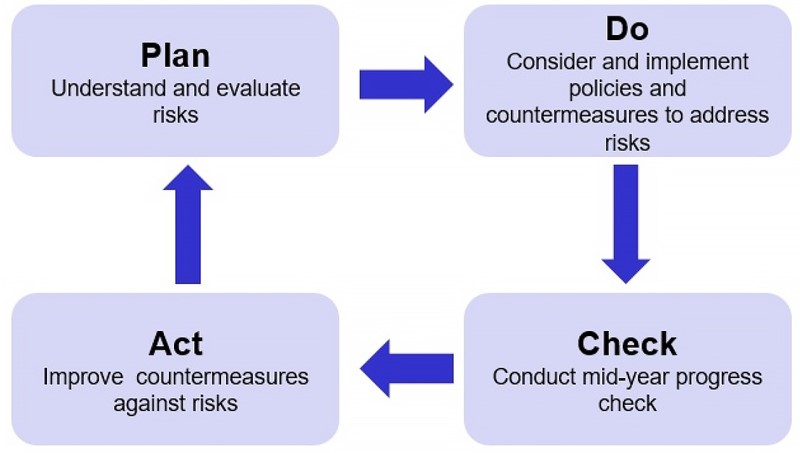

Fuji Electric manages risks systematically and organizationally in accordance with the "Fuji Electric Risk Management Regulations." In April 2021, "risks related to climate change" were added to the regulations as a risk that could affect business operations, and measures have been taken. Under these regulations, we aim to prevent risks from materializing and minimize their impact by appropriately managing and responding to "risks related to climate change."

”The year-round “risk management processes” set forth in the Rules are as follows.

Metrics and Targets

Disclosed in March 2022

Fuji Electric has formulated the Environmental Vision 2050 and has positioned its interim action goals, referred to as the Fiscal 2030 Goals, as “metrics and targets” that correspond to TCFD recommendations.

In March 2022, we revised our Fiscal 2030 Goals to establish new metrics for greenhouse gas emissions throughout the supply chain (Scope 1+2+3). Together with the existing metrics for GHG emissions in production activities (Scope 1+2), we have established the “metrics and targets” for Scope 1+2 and Scope 3 GHG emissions, which are items required for disclosure under TCFD recommendations. In the same year, our Scope1,2 and Scope3(1-8,11) targets were approved as 1.5˚C targets by the SBTi (Science Based Targets initiative).

We aim to contribute to the achievement of a decarbonized society, a recycling-oriented society, and a society that is in harmony with nature by expanding the use of Fuji Electric's innovative clean energy technologies and energy-saving products.

Achieve a Decarbonized Society: Target carbon neutrality across the supply chain