GovernanceCorporate Governance

We continue our efforts to further improve the transparency and supervisory function of management for stronger corporate governance in order to realize our corporate philosophy.

- Basic Policies

- Corporate Governance Framework

- Nomination and Remuneration Committee

- Appointment of Directors and Audit & Supervisory Board Members

- Independence Criteria for Outside Directors and Audit & Supervisory Board Members

- Activities of Outside Directors and Audit & Supervisory Board Members in Fiscal 2022

- Remuneration for Directors and Audit & Supervisory Board Members

- Training Policy for Directors and Audit & Supervisory Board Members

- Evaluation of Effectiveness of the Board of Directors

- Internal Control System

- Audit & Supervisory Board Members and Internal Audits

- Policy on Cross-Shareholding

Basic Policies

In strengthening our corporate governance, our basic policies are to protect shareholder rights and ensure their equal treatment, cooperate appropriately with non-shareholder stakeholders, ensure proper information disclosure and transparency, execute the duties of the Board of Directors, and engage in dialogue with shareholders.

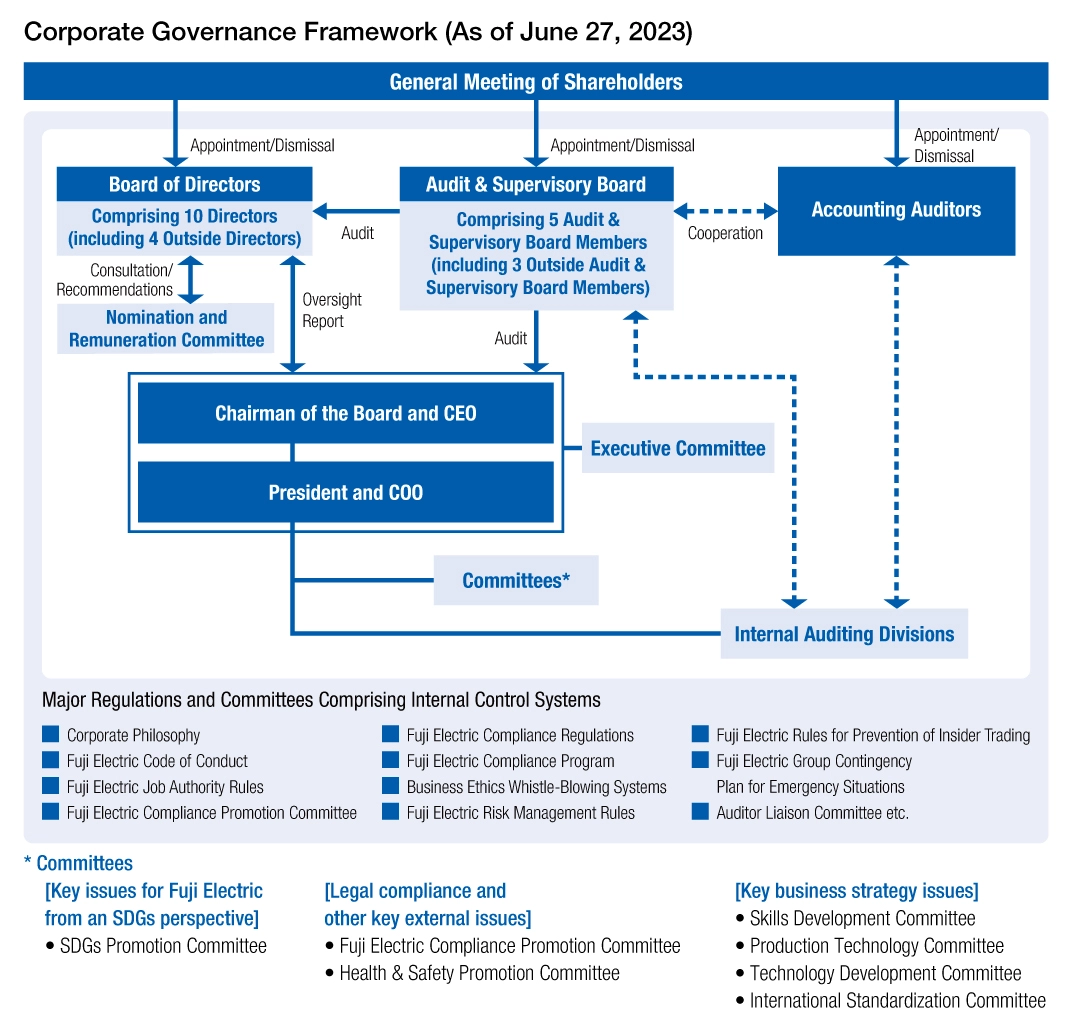

Corporate Governance Framework

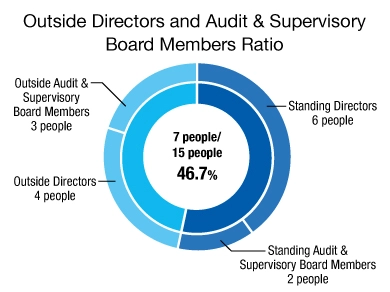

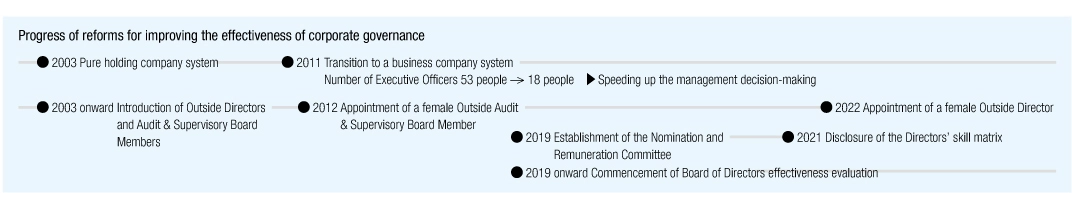

Fuji Electric’s corporate governance framework consists of the Board of Directors, which performs the functions of management supervision and making important decisions, and the Audit & Supervisory Board Members and the Audit & Supervisory Board, which are in charge of the management audit function, and the framework guarantees objectivity and neutrality.

The Company actively appoints Outside Directors and Audit & Supervisory Board Members that satisfy the requirements for independence, endeavors to strengthen management supervisory and auditing functions, and has established the Nomination and Remuneration Committee comprising a majority of Outside Directors as an advisory body to the Board of Directors.

In addition, in order to clarify the roles of management and execution, we have introduced an executive officer system to clarify the responsibilities of each business and streamline the execution of duties. In order to continue strengthening our operating platform as a company with sustainable growth, in fiscal 2022 we appointed a Chairman of the Board and CEO and President and COO. We are endeavoring to build an effective corporate governance framework by establishing the Executive Committee, which discusses and reports on important matters related to management as an advisory body to the Chairman of the Board and CEO and President and COO, as well as other committees tasked with planning and promoting key business strategy issues and key external issues, such as legal compliance.

Nomination and Remuneration Committee

Fuji Electric has established the Nomination and Remuneration Committee as the advisory body for the Board of Directors in order to enhance the Company’s corporate governance by reinforcing the fairness, transparency, and objectivity of procedures concerning the nomination of and remuneration for Directors and Audit & Supervisory Board Members.

Matters for Consultation

- Policy on the composition of the Board of Directors

- Policies and criteria regarding the appointment or dismissal of Directors, the President and Chairman of the Board of Directors, and Audit & Supervisory Board Members

- Appointment or dismissal of Directors, the President and Chairman of the Board of Directors, and Audit & Supervisory Board Members

- Matters regarding the formulation and implementation of a succession plan for the President and Chairman of the Board of Directors

- Policies and criteria regarding the remuneration of Directors and Audit & Supervisory Board Members

- Details of remuneration for Directors and Audit & Supervisory Board Members

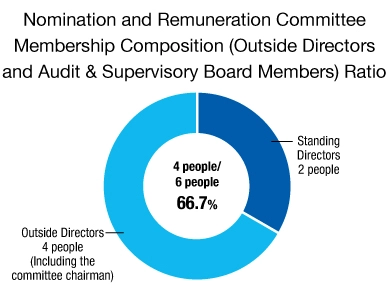

The committee comprises at least three Directors as members, the majority of which are elected from among the Company’s Outside Directors. The chairman is elected from among the Outside Directors that sit on the committee as members.

The Nomination and Remuneration Committee met three times in fiscal 2022 to discuss and confirm the current systems, criteria, and approaches regarding advisory matters, as well as to deliberate on and report to the Board of Directors the content to be reported to the Board of Directors by the Nomination and Remuneration Committee concerning content such as the appointment and remuneration of Directors and Audit & Supervisory Board Members.

Nomination and Remuneration Committee (Fiscal 2023)

The Nomination and Remuneration Committee met three times in fiscal 2021 to discuss and confirm executive remuneration, compliance with the revised Corporate Governance Code, and executive appointments, as well as to deliberate and report to the Board of Directors on advisory matters concerning appointment of Directors and Audit & Supervisory Board Members

| The Committee Chairman | Outside Director | Toshihito Tamba |

|---|---|---|

| Committee Members | Outside Directors | Yukari Tominaga, Yukihiro Tachifuji, Tomonari Yashiro |

| Standing Directors | Michihiro Kitazawa, Shiro Kondo |

Appointment of Directors and Audit & Supervisory Board Members

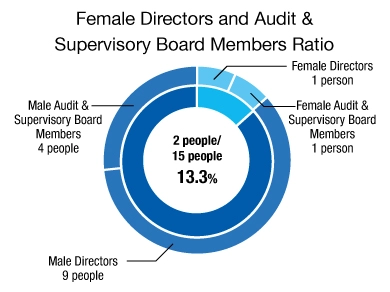

Candidates for Directors and Audit & Supervisory Board Members are decided by taking into account such factors as the overall balance of qualifications and experience on the Board of Directors, and other viewpoints such as diversity.

| Standing Directors | Persons with the qualifications, experience, and other attributes required to execute the Company’s management policies are appointed. |

|---|---|

| Outside Directors | Persons equipped with the insight and experience required to make multilateral business decisions who also have an understanding of Fuji Electric’s management are appointed, including corporate managers and experts in academic fields deeply related to our business. |

| Standing Audit & Supervisory Board Members | Persons familiar with the Company’s operations in general who also possess expert knowledge and experience are appointed. |

| Outside Audit & Supervisory Board Members | Persons equipped with the expert knowledge and experience required to undertake audits who also have an understanding of Fuji Electric’s management are appointed, including corporate managers, persons with experience as a standing auditor of a listed company, and legal experts. |

- Each Director’s term of office is one year so that we maintain the management framework capable of making clear the responsibilities of management in each fiscal year and of responding quickly to changes in the business environment.

Regarding the insight and experience required for the Board of Directors of Fuji Electric, in light of the Management Policies of Fuji Electric, including “contribute to the creation of a sustainable society through our energy and environment businesses,” and our business characteristics, we have defined the seven fields of “business management,” “finance and accounting,” “global business,” “environment and society,” “R&D, technology, manufacturing, and DX,” “corporate governance, legal matters, and risks” and “marketing and industry.”

| Areas expected to Director by the Company | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Management | Finance and Accounting | Global Business | Environment and Society | R&D, Technology, Manufacturing, and DX | Corporate Governance, Legal Matters, and Risks | Marketing and Industry | |||||

| Michihiro Kitazawa | Representative Director Chairman of the Board Chief Executive Officer |

● | ● | ● | ● | ● | ● | ||||

| Shiro Kondo | Representative Director President and Chief Operating Officer |

● | ● | ● | ● | ||||||

| Toshihito Tamba | Outside Director | ● | ● | ● | ● | ||||||

| Yukari Tominaga | Outside Director | ● | ● | ● | |||||||

| Yukihiro Tachifuji | Outside Director | ● | ● | ● | ● | ● | |||||

| Tomonari Yashiro | Outside Director | ● | ● | ● | |||||||

| Michio Abe | Director | ● | ● | ● | ● | ||||||

| Junichi Arai | Director | ● | ● | ● | |||||||

| Toru Hosen | Director | ● | ● | ||||||||

| Hiroshi Tetsutani | Director | ● | ● | ||||||||

Independence Criteria for Outside Directors and Audit & Supervisory Board Members

Fuji Electric judges the applicable candidate to be fully independent from the Company when he/she does not fall under any of the conditions listed below, in addition to the criteria for independence stipulated by domestic financial exchanges, including the Tokyo Stock Exchange.

-

Major shareholder

A major shareholder of the Company (who owns 10% or more of the voting rights) or its executor of business.

-

Major business partner

A business partner (consultants such as lawyers, certified public accountants, and tax accountants, as well as consulting firms such as law firms, audit firms, and tax firms) or a person executing its business whose transactions with the Company exceed 2% of the annual consolidated net sales of the Company or the other entity in the past three fiscal years.

-

Major lender, etc.

A financial institution, other major creditor, or a person executing the business of these institutions that is indispensable for the Company’s funding and on which the Company depends to the extent that it is irreplaceable.

-

Accounting Auditor

A certified public accountant who belongs to an auditing firm that serves as the Accounting Auditor of the Company or an employee of or any other person belonging to such auditing firm.

-

Donee

A person executing the business of an organization which receives a donation exceeding 10 million yen per year that is greater than 2% of its annual income from the Company for the past three fiscal years.

Activities of Outside Directors and Audit & Supervisory Board Members in Fiscal 2022

To strengthen our management supervisory and auditing functions, and to ensure the validity and appropriateness of our important decisions, the Directors and Audit & Supervisory Board Members play the proper roles as stated below.

Outside Directors

| Name | Status of Attendance at Board of Directors Meetings (Meetings Attended/Meetings Held) Status of Attendance at Nomination and Remuneration Committee (Meetings Attended/Meetings Held) |

Main Activities |

|---|---|---|

| Toshihito Tamba | 13/13 3/3 |

Board of Directors Mr. Tamba offered opinions as necessary on all areas of Fuji Electric’s management, including on the following matters, based on his professional standpoint and considerable insight as a manager of listed companies.

Nomination and Remuneration Committee As the committee chairman, Mr. Tamba led the supervisory function in appointment of candidates for Directors and Audit & Supervisory Board Members of the Company and the process of determining remunerations for Directors and Audit & Supervisory Board Members from an objective and neutral standpoint. |

| Naoomi Tachikawa | 13/13 3/3 |

Board of Directors Mr. Tachikawa offered opinions as necessary on all areas of Fuji Electric’s management, including on the following matters, based on his professional standpoint and considerable insight as a manager of listed companies.

Nomination and Remuneration Committee Mr. Tachikawa carried out the supervisory function in appointment of candidates for Directors and Audit & Supervisory Board Members and the process of determining remunerations for Directors and Audit & Supervisory Board Members from an objective and neutral standpoint. |

| Yoshitsugu Hayashi | 13/13 3/3 |

Board of Directors Mr. Hayashi offered opinions as necessary on all areas of Fuji Electric’s management, including on the following matters, based on his professional standpoint and considerable insight about the environment, transportation, and urban sustainable development fields that are closely related to the Company’s management policies.

Nomination and Remuneration Committee Mr. Hayashi carried out the supervisory function in appointment of candidates for Directors and Audit & Supervisory Board Members and the process of determining remunerations for Directors and Audit & Supervisory Board Members from an objective and neutral standpoint. |

| Yukari Tominaga | 9/10 -/- |

Board of Directors Ms. Tominaga offered opinions as necessary on all areas of Fuji Electric’s management, including on the following matters, based on her abundant experience and considerable insight pertaining to corporate management.

|

- Ms. Yukari Tominaga was newly appointed a Director as of the conclusion of the 146th Ordinary General Meeting of Shareholders held on June 28, 2022; therefore, the above Board of Directors attendance status covers the meetings of the Board of Directors held on or after her appointment.

Outside Audit & Supervisory Board Members

| Name | Status of Attendance at Board of Directors Meetings (Meetings Attended/Meetings Held) Status of Attendance at Audit & Supervisory Board Meetings (Meetings Attended/Meetings Held) |

Main Activities |

|---|---|---|

| Tetsuo Hiramatsu | 13/13 8/8 |

Board of Directors Mr. Hiramatsu confirmed and offered opinions as necessary concerning agenda items and the status of Fuji Electric’s business activities based on his extensive experience and considerable insight as a manager at financial institutions. Audit & Supervisory Board Mr. Hiramatsu confirmed and offered opinions on the legal compliance of the overall business activities of Fuji Electric. |

| Hirohiko Takaoka | 13/13 8/8 |

Board of Directors Mr. Takaoka confirmed and offered opinions as necessary concerning agenda items and the status of Fuji Electric’s business activities based on his extensive experience and considerable insight as an experienced Full-time Audit & Supervisory Board Member and any other type of executive of listed companies. Audit & Supervisory Board Mr. Takaoka confirmed and offered opinions on the legal compliance of the overall business activities of Fuji Electric. |

| Yuko Katsuta | 13/13 8/8 |

Board of Directors Ms. Katsuta confirmed and offered opinions as necessary concerning agenda items and the status of Fuji Electric’s business activities based on her expert knowledge as an attorney. Audit & Supervisory Board Ms. Katsuta confirmed and offered opinions on the legal compliance of the overall business activities of Fuji Electric. |

Remuneration for Directors and Audit & Supervisory Board Members

Process of determining remuneration

The Nomination and Remuneration Committee discusses policies and criteria concerning remuneration as well as the details of remuneration. The Nomination and Remuneration Committee discusses the validity of the policies, criteria, and levels of remuneration in light of changes in the operating environment, objective external data, and other matters and then reports to the Directors, and then the Board of Directors resolves on the policy for the final decisions respecting the details of the committee’s report.

The actual decision on remuneration amounts for individual Directors is left to the discretion of Representative Director Michihiro Kitazawa, but within the limit resolved at the General Meeting of Shareholders and with reference to the details of the committee’s report.

Policy regarding decisions on remuneration

We have established a remuneration system and remuneration levels that are deemed appropriate for their respective duties and in accordance with shareholder mandates, giving due consideration to the aims of securing and maintaining competent personnel and providing incentives for the improvement of business performance.

We routinely verify that the system and levels are appropriate or whether they need reviewing in light of changes in the operating environment or objective external data.

Classification-Based Remuneration System

| Classification | Remuneration System |

|---|---|

| Standing Directors |

The amount of performance-linked remuneration for Standing Directors is based on the payment level that pushes up the proportion of performance-linked remuneration when there is a rise in the consolidated ratio of operating profit to net sales, which is set as a critical target in a medium-term management plan. The previous year’s consolidated performance (e.g., net sales, operating profit, profit, and dividends) is taken into account to make the final decision. The consolidated operating profit ratio for fiscal 2022 was 8.8%, and performance-linked remuneration accounted for about 56% of the remuneration. Base Remuneration Base remuneration is a predetermined amount that is paid monthly at a certain time according to their position. A portion of the base remuneration is contributed to the director shareholding association to share the economic interests of shareholders and as an incentive to make management aware of share value. Performance-Linked Remuneration Performance-linked remuneration is paid annually at a certain time only in instances in which dividends are paid to all shareholders from retained earnings. The total amount of performance-linked remuneration shall be within 1.0% of consolidated profit for the fiscal year prior to the date of payment in order to make the link with consolidated results for each fiscal year more clearly. |

| Standing Audit & Supervisory Board Members Outside Directors and Audit & Supervisory Board Members |

A predetermined amount is paid monthly at a certain time according to their position as base remuneration. Stocks in the Company may be acquired at their own discretion. |

Remuneration by Classification (Fiscal 2022)

| Classification | Total Remuneration (Millions of Yen) |

Remuneration by Type (Millions of Yen) | Number of Recipients | |

|---|---|---|---|---|

| Base Remuneration | Performance-Linked Remuneration | |||

| Standing Directors | 753 | 311 | 441 | 8 |

| Standing Audit & Supervisory Board Members | 59 | 59 | - | 2 |

| Outside Directors and Audit & Supervisory Board Members | 70 | 70 | - | 7 |

Amount of Contributions to Director Shareholding Association and Shares of the Company Acquired (Fiscal 2022)

| Classification | Amount of Contributions to the Director Shareholding Association (Millions of Yen) | Shares of the Company Acquired (Hundreds of Shares) |

|---|---|---|

| Directors | 27 | 51 |

| Audit & Supervisory Board Members | 6 | 10 |

Training Policy for Directors and Audit & Supervisory Board Members

Before taking office, Standing Directors and Audit & Supervisory Board Members undergo compliance training, which also encompasses legal and taxation matters. They are also provided opportunities after taking office to acquire necessary knowledge on an ongoing basis.

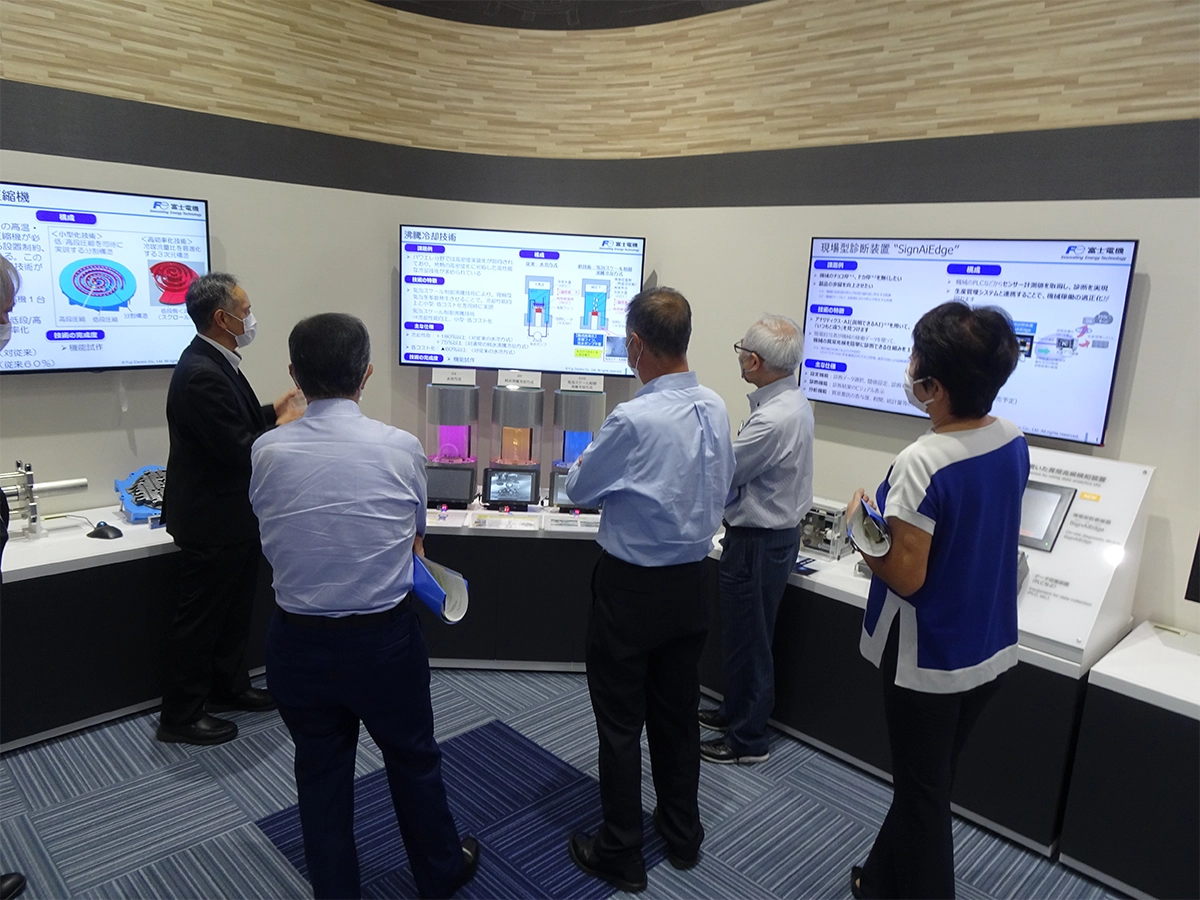

Before taking office, Outside Directors and Audit & Supervisory Board Members are briefed on the state of the Company and the roles they are expected to perform. After taking office, they have the chance to deepen their understanding of the Company through presentations on the strategies for business, R&D, and other operations, inspections of business bases, and other ways.

Evaluation of Effectiveness of the Board of Directors

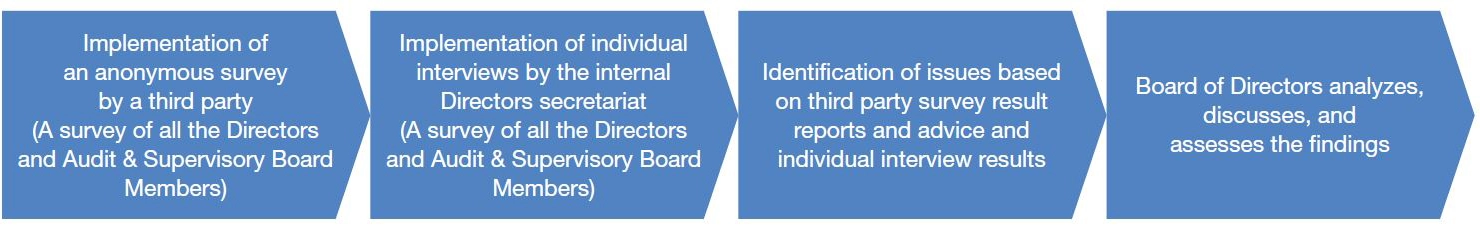

We conduct the evaluation of the effectiveness of the Board of Directors with the use of a third-party survey once a year in order to verify whether the Board of Directors is properly fulfilling its expected roles and functions and to facilitate further improvements thereof. Furthermore, in order to deeply examine the survey results, individual interviews of the Directors and Audit & Supervisory Board Members were implemented by the internal Board of Directors secretariat in fiscal 2022. Through all of these processes, we earned mostly positive assessments, thereby assuring the overall effectiveness of the Board of Directors. The results of the surveys and interviews are discussed and reported in the Board of Directors, and issues that require improvement are shared with everyone.

Method of Evaluation of Effectiveness of the Board of Directors

■ Main question categories

- Board of Directors make-up, administration, discussions, and monitoring functions

- Support structure and training for Directors and Audit & Supervisory Board Members

- Dialogue with shareholders

- Initiatives implemented by Directors and Audit & Supervisory Board Members themselves

The main initiatives in fiscal 2022 and the policies for initiatives in fiscal 2023 with respect to the major issues identified in fiscal 2021 are as follows.

Main Initiatives with Respect to the Major Issues Identified in the Effectiveness Evaluation of the Board of Directors

| Major Issues Identified in the Fiscal 2021 Effectiveness Evaluation | Major Initiatives in FY2022 | |

|---|---|---|

| Major Opinions of the Outside Directors and Audit & Supervisory Board Members | ||

| Discussion of important mediumand long-term issues | Each segment’s business plans and strategies, major issues of the SDGs Promotion Committee, personnel measures and other issues discussed in the Board of Directors |

|

| Enhancement of information provision and exchange of opinions on our business and products | Implemented R&D strategy presentations for Outside Directors and Audit & Supervisory Board Members |

|

| Report on dialogue with institutional investors | Reported in the Board of Directors on the status of IR activities as well as opinions, requests and other feedback from analysts and institutional investors |

|

| Major Issues Identified in the Fiscal 2022 Effectiveness Evaluation | Policies for Major Initiatives in FY2023 |

|---|---|

| Reporting and discussion of important medium- and long-term issues | We will continue to work on enhancing opportunities for reporting and discussing medium- and long-term issues that contribute to the enhancement of corporate value, such as the establishment of human resources strategy, financial strategy, and non-financial indicators. |

| Enhancement of the reporting required for supervising important decisions and business execution | We will continue to work on enhancing opportunities for reporting and discussing the status of business execution of each division, for example, the plan for and progress of semiconductor investment, the overview of major subsidiaries. |

Internal Control System

With the aim of complying with laws and regulations, managing the risk of loss, and securing the efficiency of the execution of duties, the Fuji Electric Board of Directors has determined basic policies concerning the establishment of an internal control system as stipulated in the Companies Act of Japan, and the Company discloses those policies. Fuji Electric discloses information on the implementation of its internal control system, thereby taking steps to respond promptly and accurately to the demands placed upon the Company by society.

Main Systems Based on the Internal Control System

Compliance system

Based on systems for ensuring that Directors and employees perform their duties in a manner that is compliant with laws and the articles of incorporation, Fuji Electric has established and promotes a compliance system in order to secure the transparency and soundness of business execution.

Risk management system

Based on regulations and other systems pertaining to managing the risk of loss, Fuji Electric has developed an appropriate risk management system in order to manage business risks in a coordinated, systematic manner. In regard to specific cross-sectional risks, the Company determines departments to put in charge of each risk, thereby establishing a risk management system.

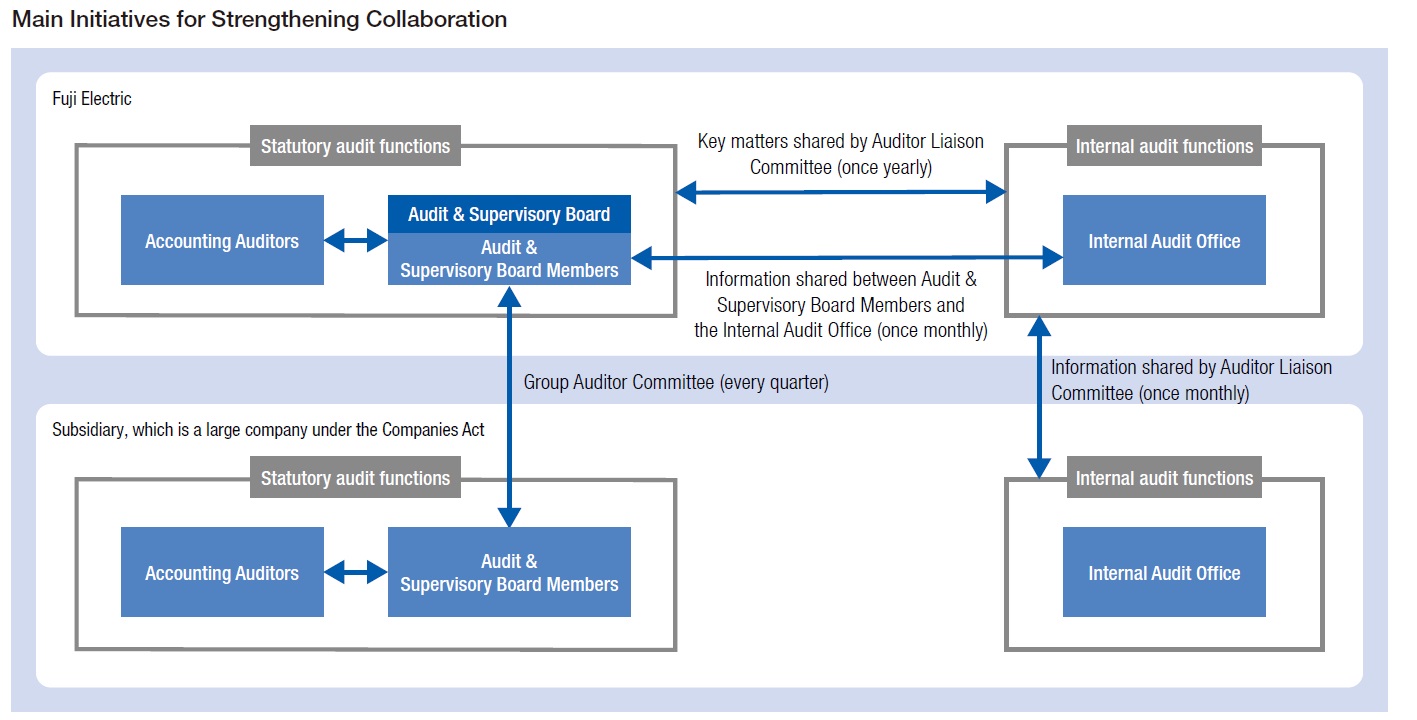

Audit & Supervisory Board Members and Internal Audits

Strengthening collaboration between audit functions

Fuji Electric ensures the effectiveness of its audit functions by reinforcing collaboration between statutory audit functions (Audit & Supervisory Board Members, Accounting Auditors) and internal audit functions (Internal Audit Office).

We will continue to strengthen this collaboration going forward, with a particular focus on project management for large-scale projects, compliance audits, and audits at overseas subsidiaries.

Audits by the Audit & Supervisory Board Members

Audit & Supervisory Board Members conduct audits in accordance with the audit policies and duties assigned and in compliance with the standards for audits established by the Audit & Supervisory Board.

They report the details and results of their audits to the Audit & Supervisory Board.

In fiscal 2022, the Audit & Supervisory Board convened eight times in total. Every meeting was attended by all of the Company’s Audit & Supervisory Board Members. During the meetings, the Audit & Supervisory Board mainly reviewed audit policies and plans, the appropriateness of auditing methods and results of the Accounting Auditors, and undertook an assessment of the Accounting Auditors. It also reported on and reviewed important matters that the Standing Audit & Supervisory Board Members communicated to the Outside Audit & Supervisory Board Members.

Main tasks

- Attending and offering opinions at meetings of the Board of Directors, the Executive Committee, the Compliance Promotion Committee, and other important committees

- Reviewing documents pertaining to important resolutions

- Receiving explanations on the status of operational execution from Directors and internal auditing divisions

- Investigating the status of operations and assets at Fuji Electric itself, its consolidated subsidiaries in Japan and overseas, and companies undertaking M&As (done remotely as necessary)

Internal audits

As a general rule, every second year the internal auditing divisions as bodies directly under the President perform the following audits on Fuji Electric’s business divisions and subsidiaries so as to comprehensively cover the entire organization in accordance with the Internal Auditing Rules.

Regarding issues pointed out, we confirm the state of progress every quarter and implement follow-up audits as required. In fiscal 2022, utilizing remote auditing, we conducted audits at 44 bases, or about 40% of the audit sites. No risks or inadequacies with the potential to seriously affect management were discovered.

| Type of Audit | Main Tasks |

|---|---|

| Organizational management | Evaluating the appropriateness of management and administration (development of regulations, approval procedures, performance management, etc.) |

| Risk management | Evaluating the effectiveness of risk management systems and risk response |

| Compliance | Checking for compliance with laws and regulations based on the Fuji Electric Compliance Program and confirming legal compliance |

| Business execution | Evaluating the appropriateness, efficiency, and effectiveness of business execution (booking of sales and purchases, investments, cash flow, etc.) |

| Accounting | Evaluating the appropriateness of cost accounting and the soundness of assets and liabilities |

Policy on Cross-Shareholding

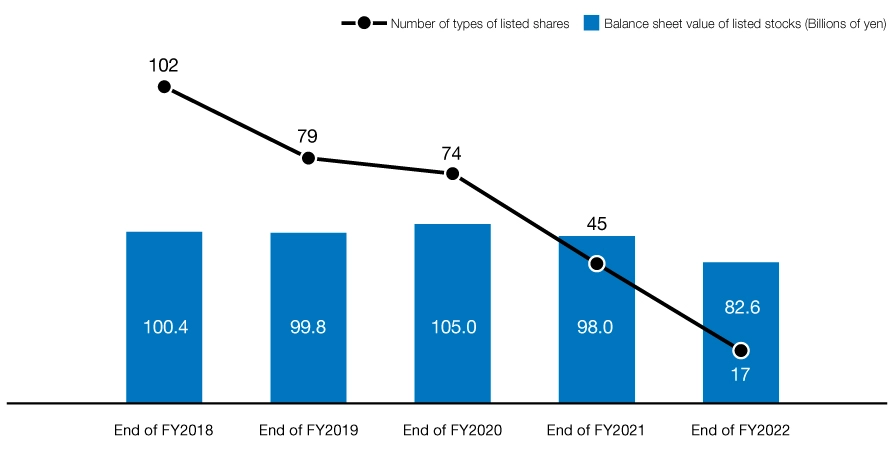

Fuji Electric holds listed shares as a matter of policy in order to maintain and strengthen relations with its investee companies. Our basic policy is to reduce crossshareholdings. Even in cases where we recognize a certain rationality in holding these cross-shareholdings, we will reduce them while paying attention to the impact on management and business.

Based on the above policy, we have reduced the number of different listed stocks we held from 102 as of the end of fiscal 2018 to 17 as of the end of fiscal 2022.

The Board of Directors periodically evaluates the rationality of shareholding in light of whether it is necessary to maintain and strengthen relations with the investee companies and of the comparison of capital cost and return. The details of the review are disclosed.

The voting rights that come with cross-shareholding are exercised after considering all relevant factors, including whether the proposed action will help the issuing company to establish an appropriate corporate governance framework and to increase its medium- to long-term corporate value, and what impact the action will have on Fuji Electric. We also have dialogue regarding the details of the proposal, among others, with the issuing company as necessary.

Number of Cross-Shareholdings and Balance Sheet Value